A History Lesson

One of the most common questions we hear from clients is “Where do you think interest rates are going?”

Virtually all of the experts we follow put rates above 5% going into next year and some see rates approaching 5.5% by the middle of 2019. What’s certain is that there are economic forces at work that are pushing rates higher.

So, how about a little history lesson? How do today’s 30- year mortgage rates compare to this same date in history going all the way back to 1990?

• Today = 4.85%

• 2017 = 3.94%

• 2015 = 3.82%

• 2010 = 4.27%

• 2005 = 5.98%

• 2000 = 7.84%

• 1995 = 7.75%

• 1990 = 10.22%

While today’s rates feel high only because they are higher than 2017, they are quite a bit lower than at many times in history.

How We Rank

Here’s how the largest Colorado cities rank on the most recent Federal Housing Finance Authority’s quarterly report. They study the appreciation rate in 245 metropolitan areas all over the country.

City Rank Appreciation

Boulder 65th 8.76%

Colorado Springs 15th 11.54%

Denver 30th 10.16%

Fort Collins 85th 7.51%

Grand Junction 58th 9.01%

Greeley 45th 9.51%

Unique Opportunity on Main Street in the Windsor Central Business District!

This home at 212 10th St is a phenomenal value as zoning allows for conversion to commercial. Close to schools and shopping. All brick ranch 4 bed 3 bath with attached garage. This home features a large living area and covered back porch. Freshly painted interior and new hardwood floors. Central A/C is not currently working. Contact John Taylor for your private showing at 970-541-1003 for more information or click the link below for more details.

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

It’s good news for the state of Colorado, which saw annual employment grow in all of the metropolitan markets included in this report. The state added 63,400 non-agricultural jobs over the past 12 months, an impressive growth rate of 2.4%. Colorado has been adding an average of 5,300 new jobs per month for the past year, and I anticipate that this growth rate will continue through the balance of 2018.

In February, the unemployment rate in Colorado was 3.0%—a level that has held steady for the past six months. Unemployment has dropped in all the markets contained in this report, with the lowest reported rates in Fort Collins and Denver, where 3.1% of the labor force was actively looking for work. The highest unemployment rate was in Grand Junction, which came in at 4.6%.

HOME SALES ACTIVITY

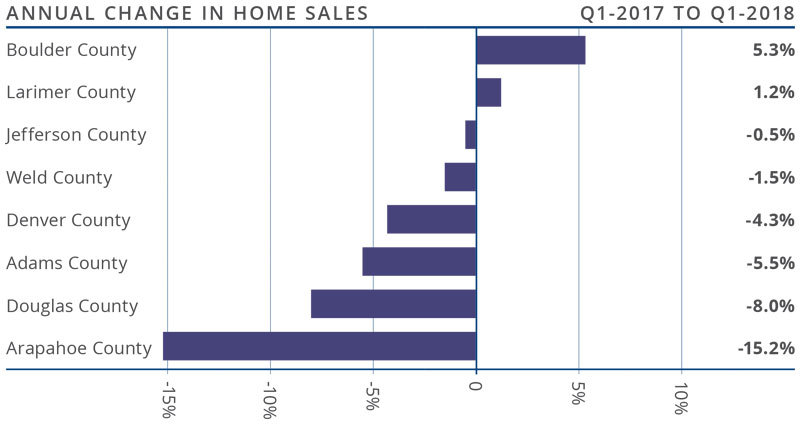

- In the first quarter of 2018, there were 11,173 home sales—a drop of 5.6% when compared to the first quarter of 2017.

- With an increase of 5.3%, home sales rose the fastest in Boulder County, as compared to first quarter of last year. There was also a modest sales increase of 1.2% in Larimer County. Sales fell in all the other counties contained within this report.

- Home sales continue to slow due to low inventory levels, which were down 5.7% compared to a year ago.

- The takeaway here is that sales growth continues to stagnate due to the lack of homes for sale.

HOME PRICES

- Strong economic growth, combined with limited inventory, continued to push prices higher. The average home price in the markets covered by this report was up by 11.7% year-over-year to $448,687.

- Arapahoe County saw slower appreciation in home values, but the trend is still positiveand above its long-term average.

- Appreciation was strongest in Boulder County, which saw prices rise 14.8%. Almost all other counties in this report experienced solid gains.

- The ongoing imbalance between supply and demand persists and home prices continue to appreciate at above-average rates.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by three days when compared to the first quarter of 2017.

- Homes in all but two counties contained in this report took less than a month to sell. Adams County continues to stand out where it took an average of just 17 days to sell a home.

- During the first quarter, it took an average of 27 days to sell a home. That rate is down 2 days from the fourth quarter of 2017.

- Housing demand remains strong and would-be buyers should expect to see stiff competition for well-positioned, well-priced homes.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. In the first quarter of 2018, I have left the needle where it was in the fourth quarter of last year. Even as interest rates trend higher, it appears as if demand will continue to outweigh supply. As we head into the spring months, I had hoped to see an increase in the number of homes for sale, but so far that has not happened. As a result, the housing market continues to heavily favor sellers.

3798 Mount Flora St., Wellington, CO

Well cared for Ranch home in Wellington!

A large corner lot in The Knolls in Wellington. Cozy up by the fireplace in the living room and enjoy the open floor plan throughout the dining and kitchen area. Have a large unfinished basement to finish to your liking!

Contact Stephanie Woodard 970-215-2676 for more information or click below to view the photos and details, including price.

https://windermerewindsor.com/listing/78295351

Do You Have ‘Average’ Credit? If so, Getting a Mortgage May Be Tough

This article originally appeared on Inman.com

In the early 2000s, getting a mortgage was hardly difficult thanks in great part to lax lending standards.

This practice eventually led to a bubble forming in the nation’s housing market — which, as we all know, subsequently burst.

Since that time, the pendulum has swung the other way — to an extreme.

Today, lenders require nothing short of pristine credit to obtain a mortgage. We can never return to the reckless lending policies of the past, but I believe they’ve gone too far, and it concerns me.

What will your credit score get you?

I took a look at data produced by the Federal Reserve and was shocked by what I saw. Of the $426.6 billion in mortgage origination during the second quarter of this year, almost 62 percent went to households with a credit rating of 760 or higher.

Borrowers with a credit score in the range of 620 to 659, which many lenders view as below-prime credit, received just 6.3 percent of the dollar volume of mortgages in the second quarter.

Now, when we compare that with the same quarter of 2004, the group with 760-or-higher credit received 23.5 percent of the mortgages, and the 620-to-659 borrowers received 8 percent.

Although surveys say credit is loosening for some types of loans, standards are still far tighter than necessary.

Too risk-averse?

The data raises questions about whether regulators and banks have become too risk-averse. It’s also possible that borrowers without prime credit have just given up owning a home for now.

Figures from property-data provider CoreLogic show that home-purchase mortgage applications from borrowers with credit scores below 640 fell to 6 percent in 2015, from 29 percent in 2005. In other words, lower-rated borrowers aren’t even applying.

But why?

Rising home values might simply be putting property out of reach for a lot of lower-income people.

For example, prices in Seattle are up 55 percent from their 2012 post-crisis low, according to the Case-Shiller Index. Nationally, prices are up 35 percent from their 2012 low.

Higher prices require larger down payments and bigger mortgage payments, especially for borrowers with lower credit scores.

But equally as culpable as rising home prices are homeowners who went through a foreclosure between 2004 and 2015.

Of these 7 million homeowners, only 7.3 percent have obtained a mortgage again, and 69 percent still have a foreclosure on their credit score, thus precluding them from buying again.

The market is making it remarkably hard for many families to buy a home.

I would never suggest that we consider returning to the “old days” of sub-prime lending, but understanding that there are a large number of families who want to buy — and who meet acceptable standards for risk — should give lenders some pause for thought.

Matthew Gardner is the Chief Economist for Windermere Real Estate, the second largest regional real estate company in the nation. Matthew specializes in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Six Key Factors That Affect the Sales Price of Your Home

Pricing a home for sale is not nearly as simple as most people think. You can’t base the price on what the house down the street sold for. You can’t depend on tax assessments. Even automatic valuation methods (AVMs), while useful for a rough estimate of value, are unreliable for purposes of pricing a home for sale.

AVMs, like those used by Zillow and Eppraisal, have been used for many years by banks for appraisal purposes. They are derived from algorithms based on past sales. But producers of AVMs agree that they are not accurate indicators of home value. For example, Zillow.com states, “Our data sources may be incomplete or incorrect; also, we have not physically inspected a specific home. Remember, the Zestimate is a starting point and does not consider all the market intricacies that can determine the actual price a house will sell for. It is not an appraisal.”

So what does Zillow recommend sellers do instead? The same thing the real estate industry has been advising for decades: Ask a real estate agent who knows your neighborhood to provide you with a comparative market analysis. To accomplish that, I typically consider the following factors—plus others, depending on the house:

Location

The location of your home will have the biggest impact on how much it can sell for. Identical homes located just blocks apart can fetch significantly different prices based on location-specific conditions unique to each, including: traffic, freeway-access, noise, crime, sun exposure, views, parking, neighboring homes, vacant lots, foreclosures, the number of surrounding rentals, access to quality schools, parks, shops, restaurants and more.

Recommendation: Be willing to price your house for less if it’s located in a less desirable area or near a neighborhood nuisance.

Market

Another major factor that also can’t be controlled is your local housing market (which could be quite different from the national, state or city housing markets). If there are few other homes on the market in your local area (a situation known as a “sellers market”), you may be able to set a higher price. However, if there’s a surplus of homes like yours for sale (a “buyer’s market”), your pricing will also reflect that.

Recommendation: If it’s a buyer’s market and you can delay selling your home until things change, you should consider doing so. If you can’t wait, be willing to price your home extremely competitively, especially if you are in a hurry to sell.

Condition

The majority of buyers are not looking to purchase fixer-uppers, which is why any deferred maintenance and repair issues can also significantly impact the selling price of your home. When your home’s condition is different than the average condition of homes in your location, AVMs tend to produce the widest range of error.

Recommendation: Hire a professional home inspector to provide you with a full, written report of everything that needs upgrading, maintenance or repair, then work with your real estate agent to prioritize the list and decide what items are worth completing before the property is listed for sale, and what should be addressed through a lower list price. Also, some defects are best addressed during negotiations with buyers.

Widespread appeal

If you want to sell your home quickly and for the most money, you have to make it as appealing as possible to the largest pool of prospective buyers. The more universally attractive it is, the greater the interest and the faster competing offers will come.

Recommendation:

Hire a professional home stager (not a decorator) to temporarily stage the interior of your home. Also spend time making the exterior look its best: address any peeling paint, make sure the front door/ door hardware is attractive, prune bushes and trees, remove old play equipment and outdoor structures, etc.

Compare homes

The only neighboring homes that should be used to estimate the value of your home are those that have been carefully selected by a real estate professional with special training, access to all sales records, and in-depth knowledge of the neighborhood.

Recommendation: If you’re considering selling your home, ask your real estate agent to recommend a professional appraiser.

Searchability

When working with a prospective buyer, most real estate agents will search the available inventory only for the homes priced at (or less than) their client’s maximum, which is typically a round number. If your home is priced slightly above or below that amount (e.g., $510,000 or $495,000), it will appear in fewer buyer searches.

Recommendation: Be willing to adjust your selling price to maximize visibility.

Periodic price adjustments

Pricing a home isn’t a set-it-and-forget-it proposal. As with any strategy, you need to be prepared to adapt to fast-changing market conditions, new competition, a lack of offers and other outside factors.

Recommendation: After listing your house, be ready to adjust your asking price, if necessary.

Refinancing: What you need to know

Thanks to all-time-low interest rates, the number of homeowners refinancing their mortgages is at an all-time high. Of course, no one should refinance just because everyone else is doing it. But, for many homeowners, the benefits are simply too hard to ignore any longer.

Save money each month. According to Freddie Mac (The country’s largest purchaser of home mortgages), the average homeowner who refinances is able to cut their monthly payment by $108 (almost $1,300 per year) for a $200,000 loan.

Save even more in the long run. If you currently have a 30-year mortgage, refinancing with a 15-year version can save you thousands of dollars in interests over the life of the loan, plus allow you to build equity in your home faster than ever.

Switch to a fixed-rate mortgage. Refinancing with a fixed-rate mortgage gives you the security of knowing that your monthly payment will remain steady, regardless of whether lending rates rise or fall in the years ahead.

Access emergency funds. Something the mortgage industry calls “cash-out refinancing” allows you to take out a new mortgage for more than your current principal balance and use the additional money for other expenses (remodeling, college, a major medical procedure, etc.). Of course, this option should only be considered if you have a real need for the money and a solid plan for paying it back.

Consolidate debt. While consolidating credit card debt under a home loan may not be wise (unless you have a plan for controlling any additional spending), refinancing to consolidate two mortgages at these record-low rates can provide significant savings in both cases.

Things to consider beforehand:

Before moving ahead with a refinance of your own, a number of factors need to be considered (and numbers crunched) before you can determine how much you’ll actually benefit and if you can qualify for the best rates:

Closing costs. The fees associated with refinancing your mortgage are called “closing costs” and generally add up to somewhere between three and six percent of your loan amount (between $7,500 and $15,000 for a $250,000 mortgage refinancing). While there are ways to lower some of those costs, you’ll still want to weigh those expenses against how much you stand to gain.

For example, let’s say you figure you’ll be able to save $100 per month by refinancing, and you’ve calculated the closing costs at about $10,000. That means you’ll need to continue living in the house for at least eight more years before the savings surpass the closing costs. In the mortgage industry, this is referred to as the break-even point; and the longer you continue living in the house beyond the break-even point, the more money you’ll save.

Your credit score. It depends on the circumstances, but most borrowers will need a credit score of 700 or higher to get access to the best rates and closing costs. To determine your score, get a copy of your credit report from Experian, Equifax and TransUnion. (Why all three? Because, if there’s any difference, most banks will use the lowest score.)

Your current level of home equity. To qualify for refinancing, your current level of “equity” (the difference between the market value of your home and the balance of your current mortgage) typically must be 20 percent or more. That means, if the market value of your home is $250,000, the remaining balance on your loan would have to be $200,000 or less.

Pre-payment penalty. Check to see if your current mortgage includes a pre-payment penalty for refinancing. That would likely make refinancing too expensive even at these record-low rates.

The importance of timing

Mortgage rates have sustained record lows over the last few years, and they will likely stay relatively low for the next few years. However, even a small increase can make a drastic change in the amount of money you will pay over the duration of your loan. Getting the lowest rate you can, will benefit your finances over the long-term.

Getting the process started is easy. Begin by checking your equity and credit score, then crunch the numbers using one of the many online mortgage calculators.

If the initial results look promising, ask your Windermere Real Estate agent for a recommendation on a reputable lender (or mortgage broker) who can provide you with an actual quote.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link