Millennial Buyers

Millennials often get a bad rap. One of the myths about Millennials is that they don’t own homes and will be renters forever.

Not true! Especially on the Front Range of Colorado.

Based on research by our very own Chief Economist, Matthew Gardner, Millennials make up a significant percentage of all home buyers in Metro Denver and Colorado.

In Metro Denver, 50% of all buyers last year were in the Millennial demographic.

In Northern Colorado, the number is 41%.

It turns out that Millennials, as they move into their mid to late 30’s, see the value of home ownership and are at the point in their lives where it makes sense to own instead of rent.

Save Your Spot

A quick, simple Fun Fact for you this week…

It’s time to sign up and register for our annual Market Forecast event.

We will be live in Denver on January 15th at the Wellshire Events Center.

And In Fort Collins on January 16th at the Marriott.

Both events start at 5:30. Choose which location works best for you.

Matthew Gardner, our Chief Economist, is the Keynote speaker.

Click the links above to RSVP.

It’s time to register for our annual Market Forecast event. We will be live at 5:30 on January 16th at the Marriott in Fort Collins. Back by popular demand is our Chief Economist Matthew Gardner. Save your seat HERE.

2020 Economic & Housing Market Forecast

As we head toward the end of the year, it’s time to recap how the U.S. economy and housing markets performed this year and offer my predictions for 2020.

U.S. Economy

In general, the economy performed pretty much as I expected this year: job growth slowed but the unemployment rate still hovers around levels not seen since the late 1960s.

Following the significant drop in corporate tax rates in January 2018, economic growth experience a big jump. However, we haven’t been able to continue those gains and I doubt we’ll return to 2%+ growth next year. Due to this slowing, I expect GDP to come in at only +1.4% next year. Non-residential fixed investment has started to wane as companies try to anticipate where economic policy will move next year. Furthermore, many businesses remain concerned over ongoing trade issues with China.

In 2020, I expect payrolls to continue growing, but the rate of growth will slow as the country adds fewer than 1.7 million new jobs. Due to this hiring slow down, the unemployment rate will start to rise, but still end the year at a very respectable 4.1%.

Many economists, including me, spent much of 2019 worried about the specter of a looming recession in 2020. Thankfully, such fears have started to wane (at least for now).

Despite some concerning signs, the likelihood that we will enter a recession in 2020 has dropped to about 26%. If we manage to stave off a recession in 2020, the possibility of a slowdown in 2021 is around 74%. That said, I fully expect that any drop in growth will be mild and will not negatively affect the U.S. housing market.

Existing Homes

As I write this article, full-year data has yet to be released. However, I feel confident that 2019 will end with a slight rise in home sales. For 2020, I expect sales to rise around 2.9% to just over 5.5 million units.

Home prices next year will continue to rise as mortgage rates remain very competitive. Look for prices to increase 3.8% in 2020 as demand continues to exceed supply and more first-time buyers enter the market.

In the year ahead, I expect the share of first-time buyers to grow, making them a very significant component of the housing market.

New Homes

The new-home market has been pretty disappointing for most of the year due to significant obstacles preventing builders from building. Land prices, labor and material costs, and regulatory fees make it very hard for builders to produce affordable housing. As a result, many are still focused on the luxury market where there are profits to be made, despite high demand from entry-level buyers.

Builders are aware of this and are doing their best to deliver more affordable product. As such, I believe single-family housing starts will rise next year to 942,000 units—an increase of 6.8% over 2019 and the highest number since 2007.

As the market starts to deliver more units, sales will rise just over 5%, but the increase in sales will be due to lower priced housing. Accordingly, new home prices are set to rise just 2.5% next year.

Mortgage Rates

Next year will still be very positive from a home-financing perspective, with the average rate for a 30-year conventional, fixed-rate mortgage averaging under 4%. That said, if there are significant improvements in trade issues with China, this forecast may change, but not significantly.

Conclusion

In this coming year, affordability issues will persist in many markets around the country, such as San Francisco; Los Angeles; San Jose; Seattle; and Bend, Oregon. The market will also continue to favor home sellers, but we will start to move more toward balance, resulting in another positive year overall for U.S. housing.

About Matthew Gardner:

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

Mortgage Rate Forecast

Geopolitical uncertainty is causing mortgage rates to drop. Windermere Chief Economist, Matthew Gardner, explains why this is and what you can expect to see mortgage rates do in the coming year.

Over the past few months we’ve seen a fairly significant drop in mortgage rates that has been essentially driven by geopolitical uncertainty – mainly caused by the trade war with China and ongoing discussions over tariffs with Mexico.

Now, mortgage rates are based on yields on 10-Year treasuries, and the interest rate on bonds tends to drop during times of economic uncertainty. When this occurs, mortgage rates also drop.

My current forecast model predicts that average 30-year mortgage rates will end 2019 at around 4.4%, and by the end of 2020 I expect to see the average 30-year rate just modestly higher at 4.6%.

Colorado Real Estate Market Update

Posted in Colorado Real Estate Market Update by Matthew Gardner, Chief Economist, Windermere Real Estate

The following analysis of the Metro Denver & Northern Colorado real estate market (which now includes Clear Creek, Gilpin, and Park counties) is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Colorado’s economy continues to grow with the addition of 44,800 new non-agricultural jobs over the past 12 months. This represents a reasonable growth rate of 1.7%. As stated in last quarter’s Gardner Report, we continue to see a modest slowdown in employment gains, but that’s to be expected at this stage of the business cycle. I predict that employment growth in Colorado will pick back up as we move through the year, adding a total of 70,000 new jobs in 2019, which represents a growth rate of 2.6%.

In February, the state unemployment rate was 3.7%, up from 2.9% a year ago. The increase is essentially due to labor force growth, which rose by more than 84,000 people over the past year. On a seasonally adjusted basis, unemployment rates in all the markets contained in this report haven’t moved much in the past year, but Boulder saw a modest drop (2.7%), and the balance of the state either remained at the same level as a year ago or rose very modestly.

HOME SALES

- In the first quarter of 2019, 11,164 homes sold — a drop of 3% compared to the first quarter of 2018 and down 13.5% from the fourth quarter of last year. Pending sales in the quarter were a mixed bag. Five counties saw an increase, but five showed signs of slowing.

- The only market that had sales growth was Adams, which rose 4.9%. The rest of the counties contained in this report saw sales decline, with a significant drop in the small Park County area.

- I believe the drop in the number of home sales is partially due to the significant increase in listings (+45.6%), which has given would-be home buyers more choice and less need to act quickly.

- As mentioned above, inventory growth in the quarter was significant, but I continue to believe that the market will see sales rise. I expect the second half of the year to perform better than the first.

HOME PRICES

- Home prices continue to trend higher, but the rate of growth is tapering. The average home price in the region rose just 2.1% year-over-year to $456,243. Home prices were .3% higher than in the fourth quarter of 2018.

- I anticipate that the drop in interest rates early in the year will likely get more buyers off the fence and this will allow prices to rise.

- Appreciation was again strongest in Park County, where prices rose 21.9%. We still attribute this rapid increase to it being a small market. Only Clear Creek County experienced a drop in average home price. Similar to Park County, this is due to it being a very small market, making it more prone to significant swings.

- Affordability remains an issue in many Colorado markets but that may be offset by the drop in interest rates.

DAYS ON MARKET

- The average number of days it took to sell a home in Colorado rose five days compared to the first quarter of 2018.

- The amount of time it took to sell a home dropped in two counties — Gilpin and Park — compared to the first quarter of 2018. The rest of the counties in this report saw days-on-market rise modestly with the exception of the small Clear Creek market, which rose by 26 days.

- In the first quarter of 2019, it took an average of 42 days to sell a home in the region, an increase of four days compared to the final quarter of 2018.

- Job growth drives housing demand, but buyers are faced with more choice and are far less frantic than they were over the past few years. That said, I anticipate the late spring will bring more activity and sales.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

For the first quarter of 2019, I have moved the needle a little more in favor of buyers. I am watching listing activity closely to see if we get any major bumps above the traditional increase because that may further slow home price growth; however, the trend for 2019 will continue towards a more balanced market.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

5 Reasons Rising Interest Rates Won’t Wreck the Housing Market

Interest rates have been trending higher since the fall of 2017, and I fully expect they will continue in that direction – albeit relatively slowly – as we move through the balance of the year and into 2019. So what does this mean for the US housing market?

It might come as a surprise to learn that I really don’t think rising interest rates will have a major impact on the housing market. Here is my reasoning:

1. First Time Home Buyers

As interest rates rise, I expect more buyers to get off the fence and into the market; specifically, first time buyers who, according to Freddie Mac, made up nearly half of new mortgages in the first quarter of this year. First-time buyers are critical to the overall health of the housing market because of the subsequent chain reaction of sales that result so this is actually a positive outcome of rising rates.

2. Easing Credit Standards

Rising interest rates may actually push some lenders to modestly ease credit standards. I know this statement will cause some people to think that easing credit will immediately send us back to the days of sub-prime lending and housing bubbles, but I don’t see this happening. Even a very modest easing of credit will allow for more than one million new home buyers to qualify for a mortgage.

3. Low Unemployment

We stand today in a country with very low unemployment (currently 4.0% and likely to get close to 3.5% by year’s end). Low unemployment rates encourage employers to raise wages to keep existing talent, as well as to recruit new talent. Wage growth can, to a degree, offset increasing interest rates because, as wages rise, buyers can afford higher mortgage payments.

4. Supply

There is a clear relationship between housing supply, home prices, and interest rates. We’re already seeing a shift in inventory levels with more homes coming on the market, and I fully expect this trend to continue for the foreseeable future. This increase in supply is, in part, a result of homeowners looking to cash in on their home’s appreciation before interest rates rise too far. This, on its own, will help ease the growth of home prices and offset rising interest rates. Furthermore, if we start to see more new construction activity at the lower end of the market, this too will help.

National versus Local

Up until this point, I’ve looked at how rising interest rates might impact the housing market on a national level, but as we all know, real estate is local, and different markets react to shifts in different ways. For example, rising interest rates will be felt more in expensive housing markets, such as San Francisco, New York, Los Angeles, and Orange County, but I expect to see less impact in areas like Cleveland, Philadelphia, Pittsburg, and Detroit, where buyers spend a lower percentage of their incomes on housing. The exception to this would be if interest rates continue to rise for a prolonged period; in that case, we might see demand start to taper off, especially in the less expensive housing markets where buyers are more price sensitive.

For more than seven years, home buyers and real estate professionals alike have grown very accustomed to historically low interest rates. We always knew the time would come when they would begin to rise again, but that doesn’t mean the outlook for housing is doom and gloom. On the contrary, I believe rising interest rates will help bring us closer to a more balanced real estate market, something that is sorely needed in many markets across the country.

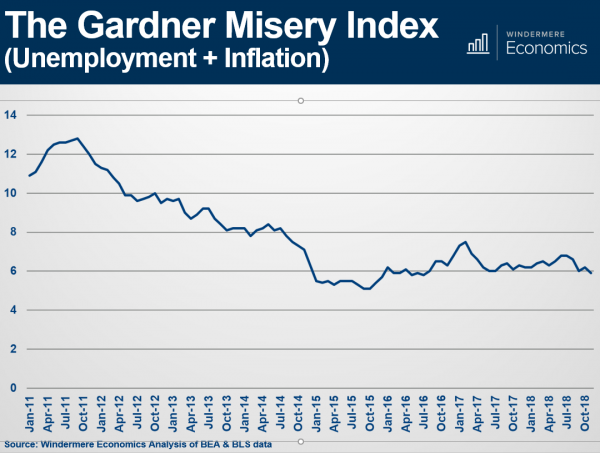

Misery Index

Last week at our Market Forecast events, Chief Economist Matthew Gardner shared, among many stats, his famous “Misery Index.”

A valuable statistic with a funny title.

The Misery Index simply measures inflation plus unemployment.

It’s an effective way to look at our Nation’s economy.

Today’s Index sits just below 6%. Back in October 2011, it was close to 13%.

The lowest it has been in the last 7 years is October 2015 when it was near 5%.

________________________________________

If you would like a copy of the entire Forecast presentation, go ahead and reach out to us.

We would be happy to put it in your hands.

What Our Expert Think

Here’s what our Chief Economist, Matthew Gardner, thinks about the 2019 U.S. Housing Market. He is regarded as one of the Country’s experts on real estate and is frequently quoted by leading industry publications.

• Existing Home Sales up 1.9% to 5.4 million units

• Home Prices up 4.4%

• New Home Sales up 6.9% to 695,000 (the highest since 2007)

If you want to see all of Matthew’s predictions including where interest rates are headed, get signed up for our annual Forecast. Click the link below!

https://www.eventbrite.com/o/windermere-real-estate-12011801121

Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me.

ECONOMIC OVERVIEW

It’s good news for the state of Colorado, which saw annual employment grow in all of the metropolitan markets included in this report. The state added 63,400 non-agricultural jobs over the past 12 months, an impressive growth rate of 2.4%. Colorado has been adding an average of 5,300 new jobs per month for the past year, and I anticipate that this growth rate will continue through the balance of 2018.

In February, the unemployment rate in Colorado was 3.0%—a level that has held steady for the past six months. Unemployment has dropped in all the markets contained in this report, with the lowest reported rates in Fort Collins and Denver, where 3.1% of the labor force was actively looking for work. The highest unemployment rate was in Grand Junction, which came in at 4.6%.

HOME SALES ACTIVITY

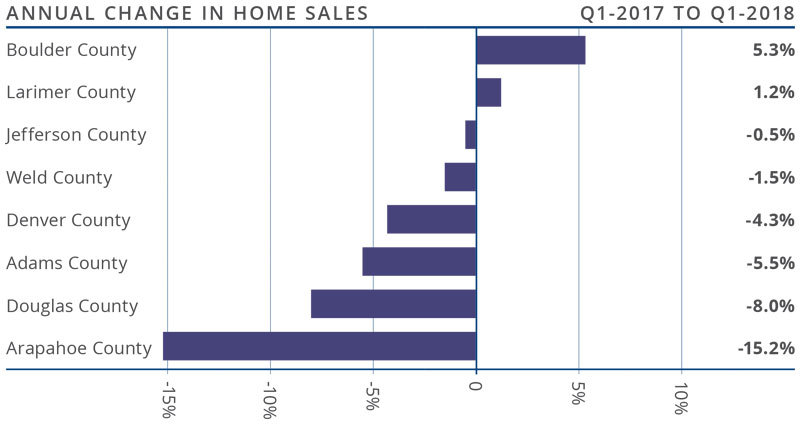

- In the first quarter of 2018, there were 11,173 home sales—a drop of 5.6% when compared to the first quarter of 2017.

- With an increase of 5.3%, home sales rose the fastest in Boulder County, as compared to first quarter of last year. There was also a modest sales increase of 1.2% in Larimer County. Sales fell in all the other counties contained within this report.

- Home sales continue to slow due to low inventory levels, which were down 5.7% compared to a year ago.

- The takeaway here is that sales growth continues to stagnate due to the lack of homes for sale.

HOME PRICES

- Strong economic growth, combined with limited inventory, continued to push prices higher. The average home price in the markets covered by this report was up by 11.7% year-over-year to $448,687.

- Arapahoe County saw slower appreciation in home values, but the trend is still positiveand above its long-term average.

- Appreciation was strongest in Boulder County, which saw prices rise 14.8%. Almost all other counties in this report experienced solid gains.

- The ongoing imbalance between supply and demand persists and home prices continue to appreciate at above-average rates.

DAYS ON MARKET

- The average number of days it took to sell a home dropped by three days when compared to the first quarter of 2017.

- Homes in all but two counties contained in this report took less than a month to sell. Adams County continues to stand out where it took an average of just 17 days to sell a home.

- During the first quarter, it took an average of 27 days to sell a home. That rate is down 2 days from the fourth quarter of 2017.

- Housing demand remains strong and would-be buyers should expect to see stiff competition for well-positioned, well-priced homes.

CONCLUSIONS

This speedometer reflects the state of the region’s housing market using housing inventory, price gains, home sales, interest rates, and larger economic factors. In the first quarter of 2018, I have left the needle where it was in the fourth quarter of last year. Even as interest rates trend higher, it appears as if demand will continue to outweigh supply. As we head into the spring months, I had hoped to see an increase in the number of homes for sale, but so far that has not happened. As a result, the housing market continues to heavily favor sellers.

Do You Have ‘Average’ Credit? If so, Getting a Mortgage May Be Tough

This article originally appeared on Inman.com

In the early 2000s, getting a mortgage was hardly difficult thanks in great part to lax lending standards.

This practice eventually led to a bubble forming in the nation’s housing market — which, as we all know, subsequently burst.

Since that time, the pendulum has swung the other way — to an extreme.

Today, lenders require nothing short of pristine credit to obtain a mortgage. We can never return to the reckless lending policies of the past, but I believe they’ve gone too far, and it concerns me.

What will your credit score get you?

I took a look at data produced by the Federal Reserve and was shocked by what I saw. Of the $426.6 billion in mortgage origination during the second quarter of this year, almost 62 percent went to households with a credit rating of 760 or higher.

Borrowers with a credit score in the range of 620 to 659, which many lenders view as below-prime credit, received just 6.3 percent of the dollar volume of mortgages in the second quarter.

Now, when we compare that with the same quarter of 2004, the group with 760-or-higher credit received 23.5 percent of the mortgages, and the 620-to-659 borrowers received 8 percent.

Although surveys say credit is loosening for some types of loans, standards are still far tighter than necessary.

Too risk-averse?

The data raises questions about whether regulators and banks have become too risk-averse. It’s also possible that borrowers without prime credit have just given up owning a home for now.

Figures from property-data provider CoreLogic show that home-purchase mortgage applications from borrowers with credit scores below 640 fell to 6 percent in 2015, from 29 percent in 2005. In other words, lower-rated borrowers aren’t even applying.

But why?

Rising home values might simply be putting property out of reach for a lot of lower-income people.

For example, prices in Seattle are up 55 percent from their 2012 post-crisis low, according to the Case-Shiller Index. Nationally, prices are up 35 percent from their 2012 low.

Higher prices require larger down payments and bigger mortgage payments, especially for borrowers with lower credit scores.

But equally as culpable as rising home prices are homeowners who went through a foreclosure between 2004 and 2015.

Of these 7 million homeowners, only 7.3 percent have obtained a mortgage again, and 69 percent still have a foreclosure on their credit score, thus precluding them from buying again.

The market is making it remarkably hard for many families to buy a home.

I would never suggest that we consider returning to the “old days” of sub-prime lending, but understanding that there are a large number of families who want to buy — and who meet acceptable standards for risk — should give lenders some pause for thought.

Matthew Gardner is the Chief Economist for Windermere Real Estate, the second largest regional real estate company in the nation. Matthew specializes in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics, and has over 25 years of professional experience both in the U.S. and U.K.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link