Versus 2019

Because 2021 and 2020 were such unique years in real estate because of the considerably low interest rates, many people in our industry believe it makes sense to compare 2022 to 2019 when looking at the key statistics.

Here’s how 2022 looked along the Front Range compared to 2019:

Prices Number of Transactions Properties for Sale

Larimer County +41% -6% -37%

Weld County +39% +2% -16%

Metro Denver +40% -14% -6%

Generally, what we notice is that:

- Prices are up significantly

- The number of transactions is similar

- Inventory is down compared to 2019 even though it is more than double 2021’s inventory

The annual Market Forecast featuring Chief Economist Matthew Gardner is February 1st at 5:30pm. To see the details and to RSVP, visit www.ColoradoForecast.com

The Big News

The big news this week is obviously the rise in interest rates.

Average 30-year fixed mortgage rates are now at 6.7% which is the highest they have been since July 2007.

So, how is this affecting the market? Here is what we notice…

There are fewer buyers in the market. Sales activity, measured by closed and pending sales, is down 30% compared to last year.

Prices, however, continue to rise. Average prices are roughly 11% higher than last year. This is driven by the market being under-supplied.

Inventory levels, as measured by months of supply, tells us we still have a Seller’s market. There is 2 month’s of supply currently for sale.

Ultimately, we expect the rise in interest rates to slow the pace of price appreciation. We believe the market will return to its long-term average of 6% per year.

What We Notice

Here is what we notice about the market right now:

- Listings are receiving fewer offers compared to 60 days ago – instead of 10 offers, a listing might have 2.

- There are now several instances of a listing only having one offer.

- Sellers who were overly-aggressive with their list price have to quickly reduce in order to generate activity.

- Inventory is up and in some areas significantly, giving buyers more options and flexibility.

- Home buyers who are under contract with a new home waiting for that new home to be built have been negatively impacted by rising rates.

- More buyers are considering 7 and 10-year mortgage products in order to have a lower interest rate.

- The pendulum is swinging away from the drastic seller’s market we have seen for the last 18 months.

Interest-ing

The recent increase in mortgage rates has started some home buyers to look at programs that have fixed rates for 7 years or 10 years instead of 30 years.

If a buyer believes it is likely they will move or even refinance within this timeframe, these types of programs can be a good option.

The obvious benefit is a lower monthly payment compared to a 30-year program.

Another benefit, which most people underestimate, is the savings in interest.

Today, for example, a buyer would have these options:

- 5.25% 30-year fixed

- 4.375% 10-year fixed

- 4.125% 7-year fixed

Over the first five years of the loan, the buyer would pay the following amounts in interest for each loan program for a $400,000 loan:

- $101,126 for 30-year

- $83,764 for 10-year

- $78,831 for 7-year

So the savings in interest over the first five years compared to the 30-year program is:

- $17,362 for 10-year

- $22,295 for 7-year

Money at a Discount

This week, for the first time in 32 months, mortgage rates hit 4%.

While this increase may feel painful for buyers currently looking at property, it is important to put today’s rates in perspective.

We believe we will look back a few years from now and see that a 4% rate was like buying money at a discount.

Interest rates hovered between 4.5% and 3.75% for the 8-year span of June, 2011 to June 2018

Between January, 2000 and December, 2010 rates were as high as 8.25% and as low as 5.0%.

When looking at the history of interest rates and researching economists’ forecasts, we believe it is reasonable for rates to hit 5% within the next 24 months.

When interest rates increase 1%, a buyer’s monthly payment increases 10%.

So, if rates do go to 5%, it is like an additional 10% price increase for a buyer.

Given all of this information, we believe the biggest risk to a buyer in today’s market is to wait.

Mortgage rates are likely on their way up and there is an opportunity to buy money at a discount today.

Why List Now

Why does it make sense to list a home now? Shouldn’t I wait until the Spring?

These are legitimate questions we hear occasionally from our clients.

It turns out there are several good reasons to list a home in December or January instead of waiting for April or May.

The first reason is low competition. Today there are only:

- 279 homes for sale in Larimer County

- 263 homes for sale in Weld County

- 2,151 homes for sale in Metro Denver

So, a home on the market today has high odds of standing out in the market versus the higher-inventory market in the Spring.

In addition to lower competition:

- Buyers looking in the winter tend to be more serious and motivated by tighter timelines

- Interest rates will likely be higher in the Spring which will impact the purchasing power of Buyers, and consequently, the selling power of Sellers.

Want a house in Fort Collins? Grab $500,000, get in line and join the housing Hunger Games

“Buying a house in Fort Collins these days can feel like a combat sport. Maybe more like the

‘Hunger Games.’ Or Charlie Brown and the football — every time you get close to the ball,

Lucy whisks it away…”

Pat Ferrier at the Fort Collins Coloradoan breaks down the housing market in Northern Colorado with the help real estate professionals across the front range. Click the link below to read on!

Fort Collins real estate_ Average home price near $500K in market

New Rate Prediction

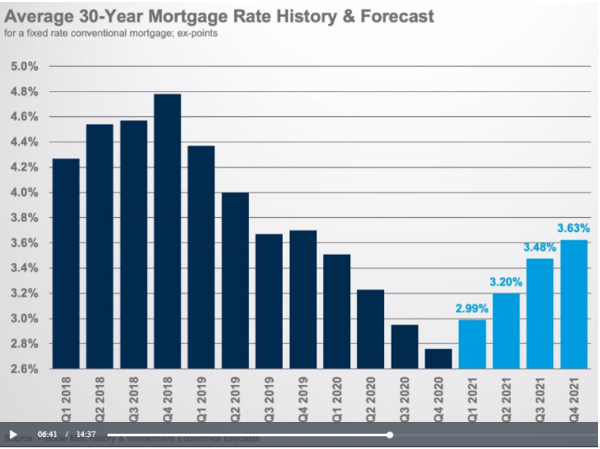

Windermere’s Chief Economist, Matthew Gardner has made his new mortgage interest rate prediction for 2021.

You can see his breakdown of interest rates and other economic factors by clicking on the image below and watching his newest video.

By the end of the year he predicts rates will rise to 3.63%. By the end of the 3rd quarter, he sees rates at 3.48%.

This would be a 0.5% increase by year-end compared to today.

What this would mean for home buyers is a 5% higher monthly payment compared to today.

Yes is the Answer

It turns out that ‘yes’ is the answer to the most common questions we hear right now about the market…

Do you think more properties will come on the market this Spring? Yes, the normal pattern in our market is for new listings to be 40% to 70% higher in April versus January. The peak month for new listings is typically June.

Do you think buyer demand will grow even more as time goes on? Yes, for two main reasons. Buyer activity, just like listing activity, increases significantly in the Spring and Summer. Plus, we expect the economy to open up even more as the COVID vaccine gets rolled out over the course of the year.

Do you think interest rates will go up? Yes, all of the trusted forecasters and economists expect rates to be slightly higher by the end of the year. Our own Chief Economist sees rates at 3.07% by year-end.

Do you think prices will keep rising? Yes, because of the simple economic forces of supply and demand. Supply is at historic lows. The number of properties for sale today is roughly 80% below the average. Demand is being fueled not only by the low-interest rates, but also a rebounding local job market that is poised to rebound even more. Plus, the new work-from-home dynamic positions the Front Range as a sought after place to live.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link