Delinquent Indicator

A leading indicator of the health of any real estate market is Mortgage Delinquencies.

Specifically, the percentage of mortgages which are at least 30 days delinquent can foretell the amount of distressed properties that may hit the market in the future.

The most recent research shows that only 4.11% of all loans are delinquent.

This number has dropped for seven quarters in a row and is now at its lowest level since the fourth quarter of 2019 (which was the lowest ever in 20 years).

It is worth noting that the delinquency rate in the years leading up to the housing bubble hovered between 5.5% to 6.0%.

Based on this data, the likelihood of a foreclosure surge or a glut of distressed properties hitting the market is minimal.

Q1 2022 Colorado Real Estate Market Update

The following analysis of select counties of the Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The most recent jobs data showed that by February of this year Colorado had recouped all of the more than 375,000 jobs that were shed due to the pandemic and had added an additional 6,000 positions. The recovery in employment was faster than I had expected, which has led me to revise my 2022 forecast: I now predict that the Colorado job market will increase by 4% this year and will add more than 112,000 new jobs. The state unemployment rate in February was 4%, which is well below the pandemic peak of 11.8% but still above the 2.6% average in 2019. Regionally, unemployment rates ranged from a low of 3.1% in Boulder to a high of 4% in the Colorado Springs and Greeley metropolitan areas.

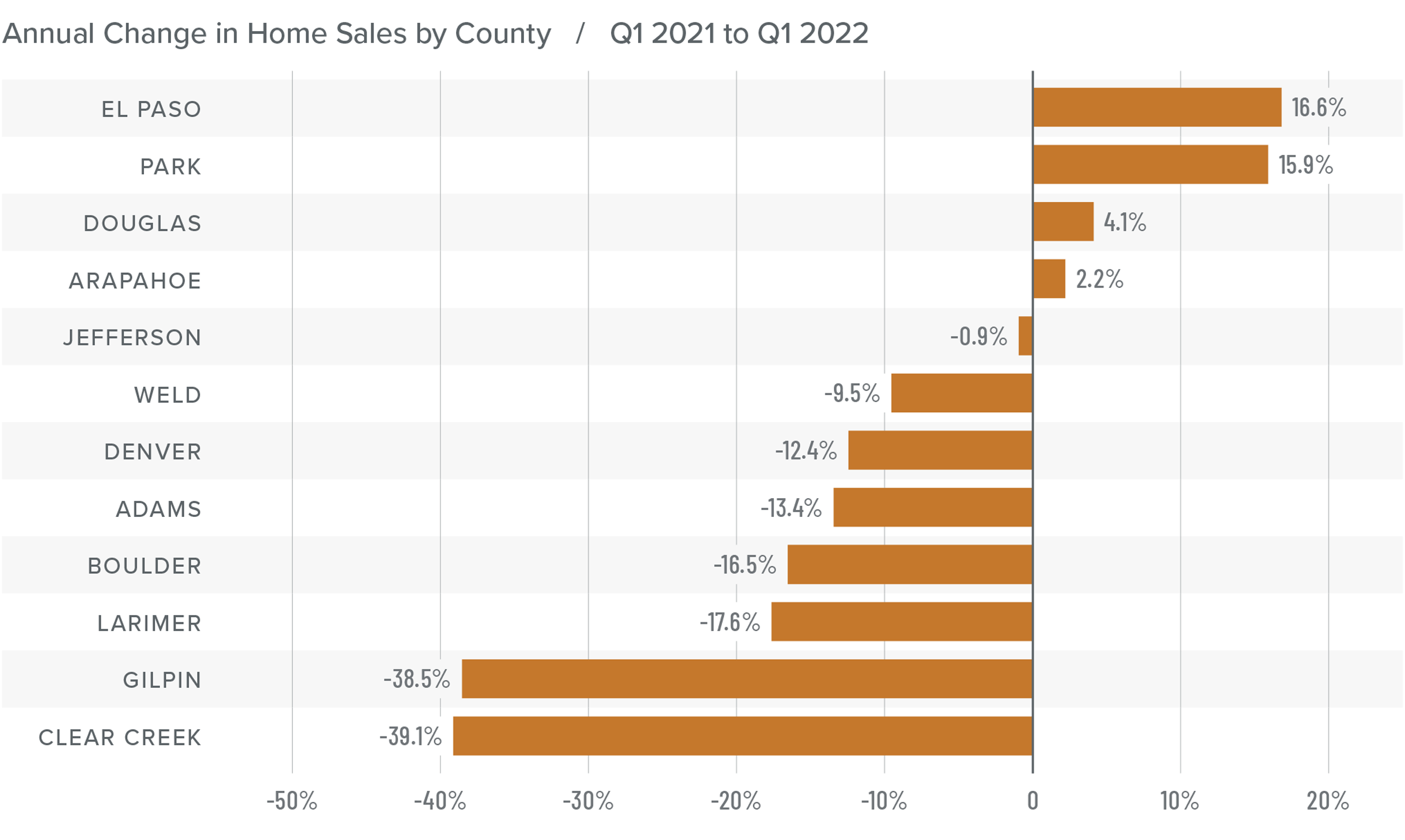

Colorado Home Sales

❱ In the first quarter of the year, 8,178 homes sold, representing a drop of 6.3% compared to the same period a year ago and 30% lower than in the fourth quarter of 2021.

❱ Sales increased in 4 of the 12 counties covered by this report but fell in the balance of the market areas.

❱ Similar to last quarter, low inventory levels continue to constrict sales. Listing activity was 17.3% lower than the same period in 2021 and 29.5% lower than in the fourth quarter of 2021.

❱ Pending sales, which are an indicator of future closings, also declined, though the drop of 4.3% is not that significant. That said, unless we see a surge in inventory levels in the spring, second quarter sales may also be light.

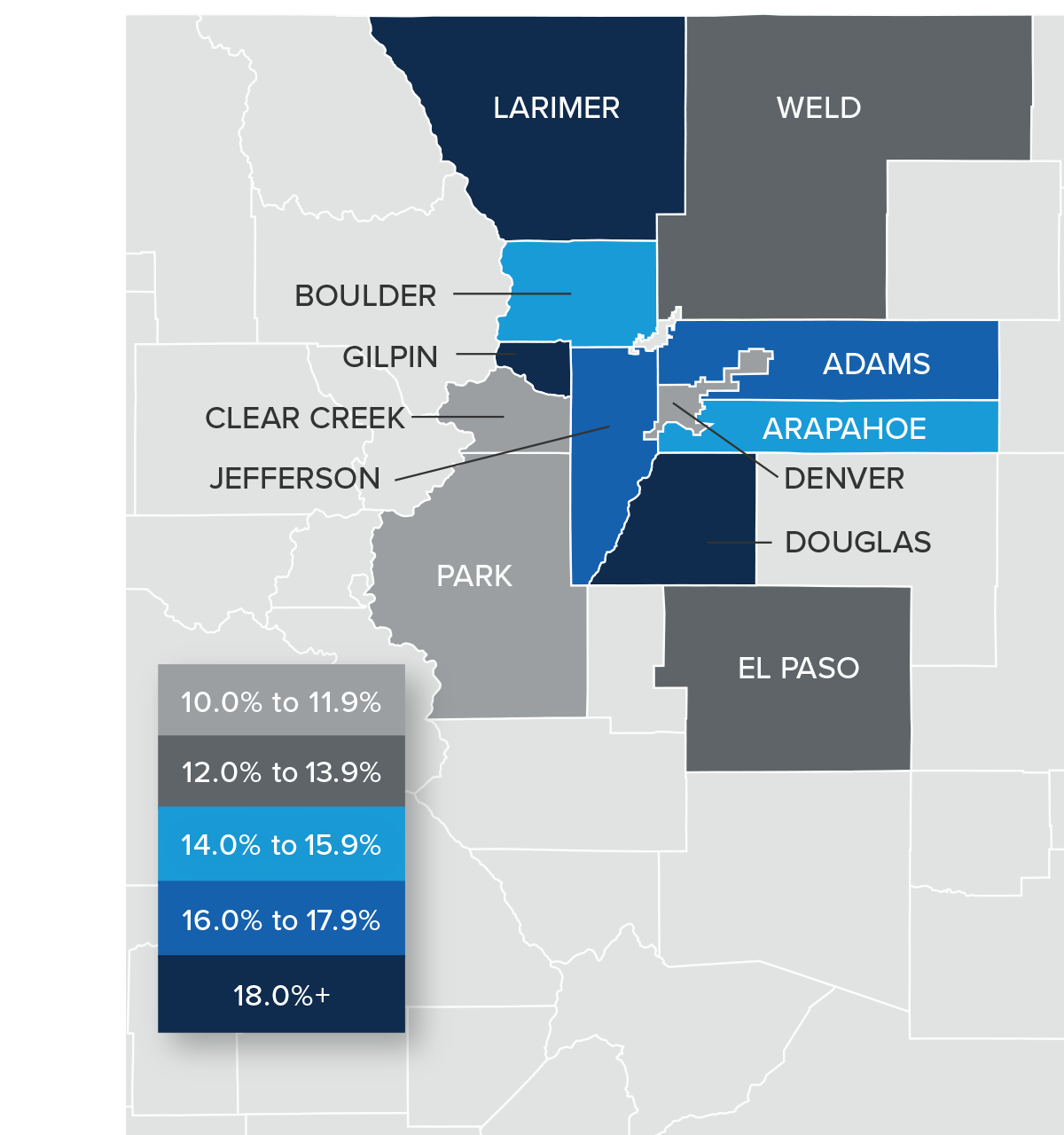

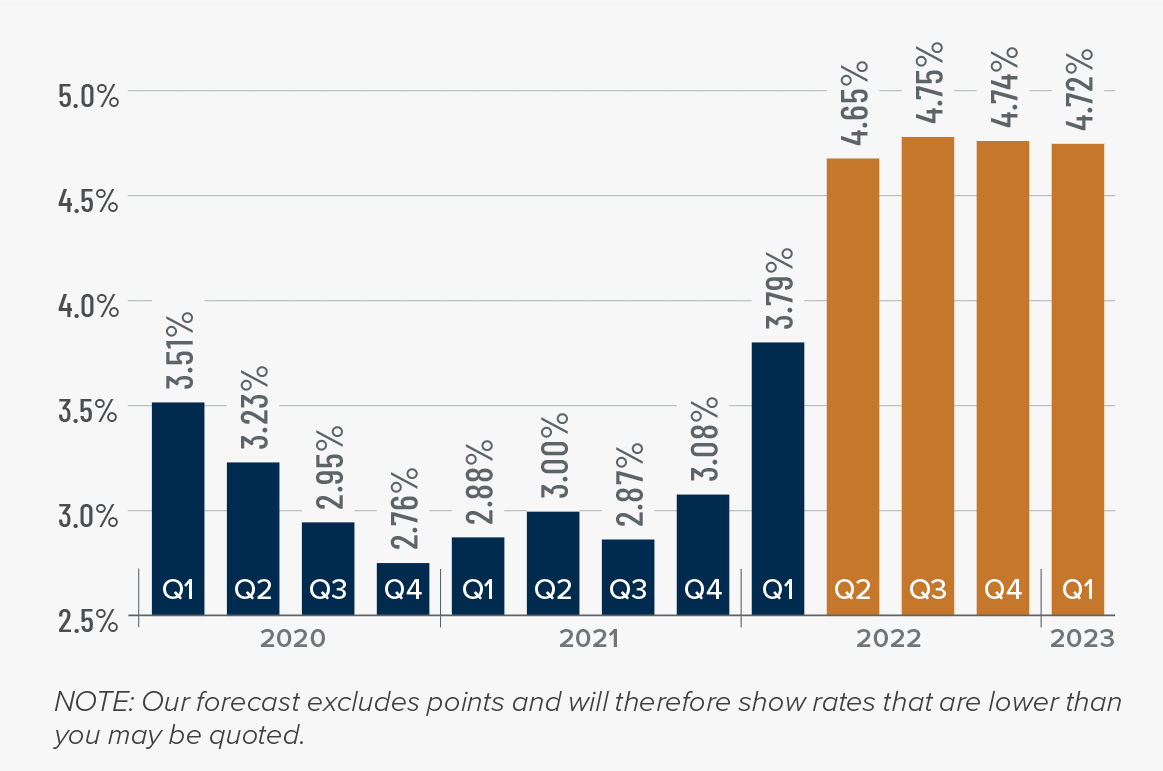

Colorado Home Prices

❱ With limited inventory and rising mortgage rates, buyers were motivated, as demonstrated by the 14.9% increase in average prices compared to a year ago. Home prices in first quarter averaged $637,963, which is 4.5% higher than last quarter.

❱ Boulder County continues to see average sale prices holding above $1 million. Although we have seen some softening in list prices, I expect this market to remain above the $1 million mark as we move through the year.

❱ Year over year, prices rose by double-digits across all markets covered by this report, with a huge jump in the small Gilpin market.

❱ With little in the way of choice for buyers—as well as a “fear of missing out” given rising mortgage rates—it’s no surprise there was such solid price appreciation. That said, there is normally a lag between rising rates and any impact on home prices. The second quarter should indicate if the jump in rates has had a softening effect on price growth.

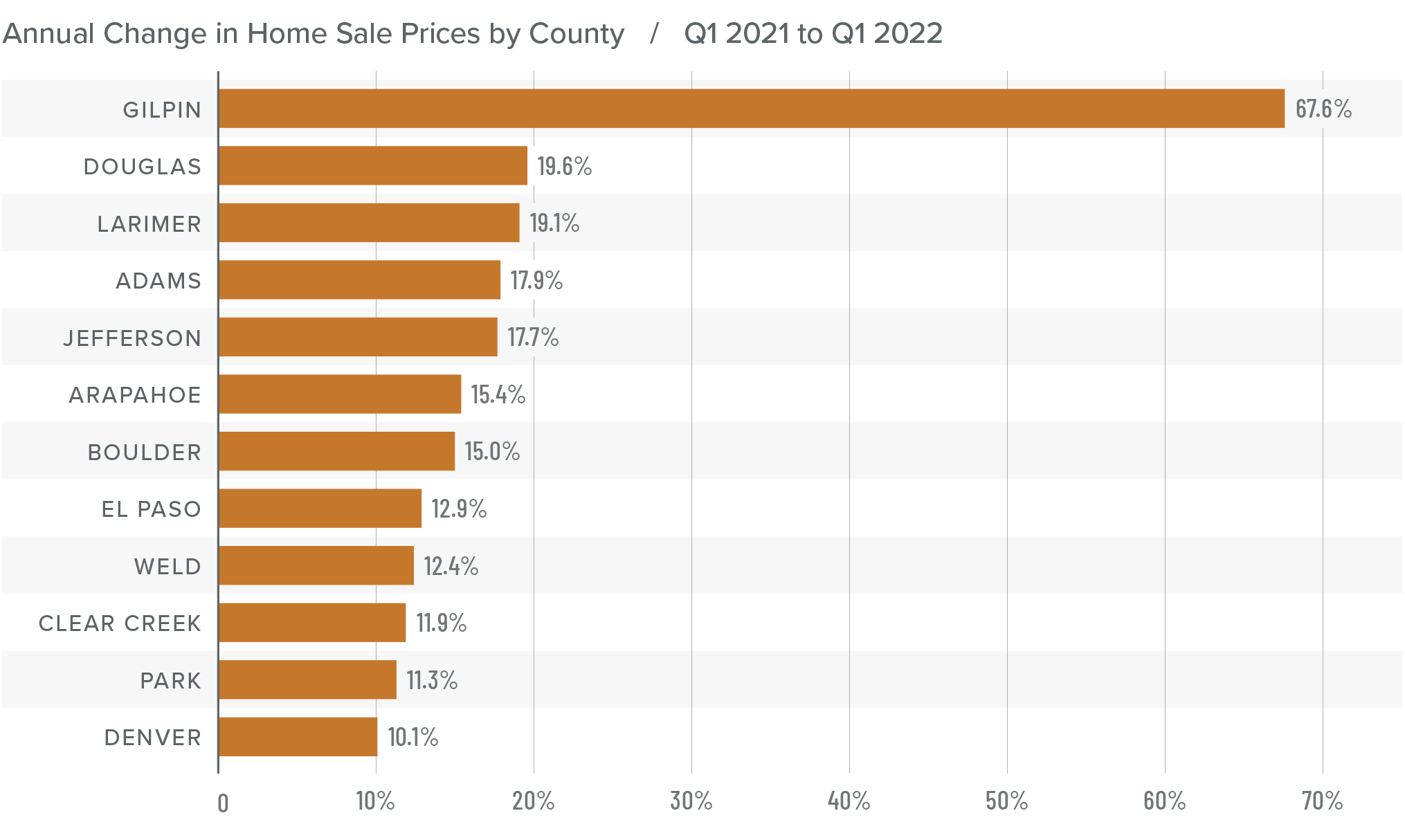

Mortgage Rates

Average rates for a 30-year conforming mortgage were 3.11% at the end of 2021, but since then have jumped over 1.5%—the largest increase since 1987. The surge in rates is because the market is anticipating a seven- to eight-point increase from the Federal Reserve later this year.

Because the mortgage market has priced this into the rates they are offering today, my forecast suggests that we are getting close to a ceiling in rates, and it is my belief that they will rise modestly in the second quarter before stabilizing for the balance of the year.

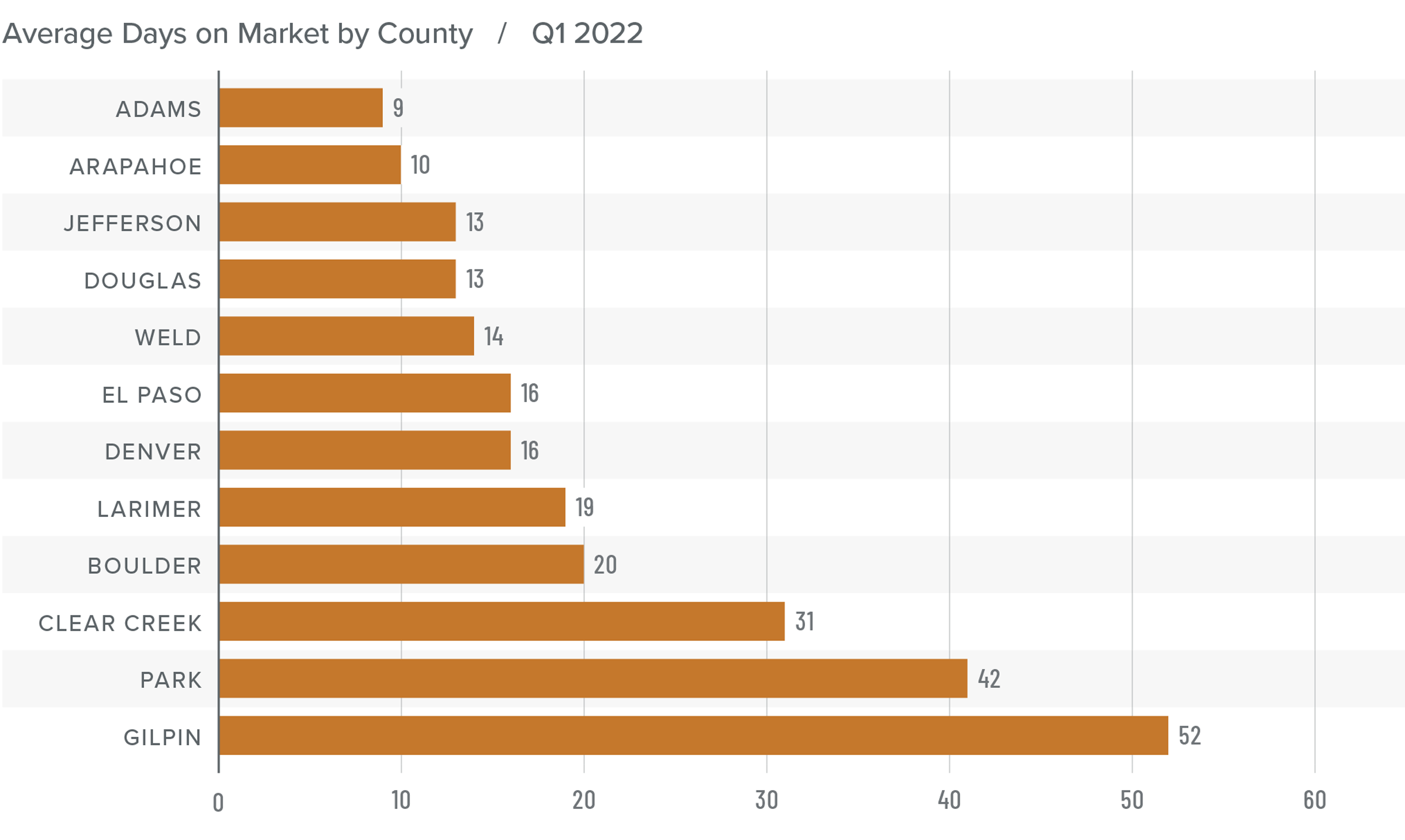

Colorado Days on Market

❱ The average number of days it took to sell a home in the markets contained in this report fell four days compared to the first quarter of 2021.

❱ The length of time it took to sell a home dropped in every county other than Gilpin compared to the same quarter a year ago.

❱ It took an average of only 21 days to sell a home in the region, matching the previous quarter.

❱ Compared to the final quarter of 2021, average market time fell in Clear Creek, Adams, Denver, Jefferson, and Arapahoe counties, but rose in the balance of the markets contained in this report.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

With Colorado on solid economic footing, I expect housing demand to remain strong even in the face of rising financing costs. Inventory levels remain very low, and new home construction has not expanded enough to meet demand, which continues to put upward price pressure on resale homes. The market appears to have shrugged off the jump in mortgage rates in the first quarter, but the full effects won’t be felt until later this spring. We’ll have to wait and see what impact, if any, there will be, but data on listing prices shows that home sellers remain bullish.

Given all these factors, I am leaving the needle in the same position as last quarter. The market clearly still favors sellers, but we need a few more months of information to determine how rising mortgage rates may impact home sales and/ or prices.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

10 Steps to Get Your Home Clean and Ready for Spring

Warmer months are ahead, so now is the time to plan for spring cleaning and maintenance. A clean home offers a fresh start for the year, and a checklist of tasks guides your efforts towards efficiency. For many homeowners, spring cleaning can be a personal challenge. It can also be one accomplished with the help of the rest of the family or other residents. In some occasions, however, professional assistance may be advised, or even necessary. Regardless, regular home maintenance not only increases your home’s value, but it can also make your home more comfortable and enjoyable.

Indoors

Check Your Attic

Once summer arrives, it can be too hot in many regions to comfortably perform an inspection. Use late winter and early spring to ensure the following: there’s ample insulation (10 to 14 inches), there are no signs of mice or rats (droppings, strong odor, nests), there are no bugs (flying, crawling, or otherwise), and there are no signs of roof leaks (water stains, etc.).

Schedule HVAC Maintenance

Annual tune-ups on your heating/cooling equipment will reduce your energy bill and help ensure you can maintain a comfortable indoor temperature.

Fix the Window Screens

It won’t be long before you’ll want to throw open the windows for fresh air, or relief on a warm afternoon. Take time now to ensure your window screens are ready for the challenge. Many traditional neighborhood hardware stores still offer re-screening services. Contractors also specialize in this service and are available for house calls.

Clean the Ceiling Fans

During the warm weather and the cold, ceiling fans can help moderate the temperature and better distribute the air. But your fans will be far more efficient if you give them a good cleaning a couple times each year. For fans mounted up to 10 feet in the air, you can use a ladder to access the tops of the fan blades. For those mounted on vaulted ceilings, use a long-handled duster.

Apply Weather Stripping

Many homeowners think of weather stripping as a cold-weather commodity, but it’s just as important during summer. To keep the cool air in and the hot air out, use any of the many filler materials available to seal gaps around windows, doors, exhaust fans, and any other point where you can see light peeking through.

Outdoors

Look for Damaged Roof Shingles

Use binoculars (with your feet safely planted on the ground) to scan for roof shingles that are curling, broken, or missing. If anything seems compromised, have a roofing company perform an inspection and provide a bid. If you or any members of your family are enterprising drone users, a camera-affixed drone can also be a useful aid in this reconnaissance effort.

Wash the Exterior

An easy way to extend the life of your exterior paint – and make your house look better than ever – is to give the siding a good washing. Use mostly water (to avoid harming any plants) and a stiff pole brush.

Search Out Rotten Wood

While you’re washing the exterior, keep an eye out for areas where there may be rot. Use a screwdriver to gently but firmly press on any siding or trim where you see black mold, missing paint, or exposed gray wood. If the area you’re probing feels mushy or bone-dry, contact a contractor to assess and stabilize the situation.

Clean the Gutters

All it takes is a handful of leaves to clog a gutter downspout and cause overflow and flooding. Hire a professional to give the gutters a thorough cleaning and you’ll avoid the very real dangers of working from a ladder. If you live in an area with lots of trees, consider getting quotes for some of the leaf-less gutter systems.

Prepare Your Lawn to Grow

The winter sets impediments for your lawn, and it takes preparation to help it shine. Rake away any dead grass and aerate the whole lawn to allow nutrients to access the roots. Reseed bare spots and apply a spring fertilizer to ensure your lawn has the fuel it needs to grow strong and beautiful.

Half A Month

There is half of a month of inventory on the market. In other words, at the current pace of sales, it would take just two weeks to sell all of the homes currently listed for sale along the Front Range.

By definition, a market is balanced when there is 4 to 6 months of inventory. Anything less than that is a seller’s market.

The current inventory levels give us confidence about the future of price growth along the Front Range.

While we expect the pace of price appreciation to slow, the low supply of properties insulates us against any sort of price decline.

Interest-ing

The recent increase in mortgage rates has started some home buyers to look at programs that have fixed rates for 7 years or 10 years instead of 30 years.

If a buyer believes it is likely they will move or even refinance within this timeframe, these types of programs can be a good option.

The obvious benefit is a lower monthly payment compared to a 30-year program.

Another benefit, which most people underestimate, is the savings in interest.

Today, for example, a buyer would have these options:

- 5.25% 30-year fixed

- 4.375% 10-year fixed

- 4.125% 7-year fixed

Over the first five years of the loan, the buyer would pay the following amounts in interest for each loan program for a $400,000 loan:

- $101,126 for 30-year

- $83,764 for 10-year

- $78,831 for 7-year

So the savings in interest over the first five years compared to the 30-year program is:

- $17,362 for 10-year

- $22,295 for 7-year

Active Average

While we frequently research and discuss average prices for properties that sell, it is also interesting to look at the average prices for properties that are active on the market but not sold yet.

These are the average prices, by area, for properties currently listed for sale and not sold yet:

- Metro Denver = $954,000

- Larimer County = $878,000

- Weld County = $880,000

If you are surprised that Weld County is higher than Larimer County, it’s important to note that there are several large acreage properties listed for sale in Weld County which are skewing the average.

These average active prices are all roughly 30% higher compared to a year ago and further emphasize the strong activity in the Front Range market.

Common Real Estate Contingencies

Contingencies help to spell out the specifics of a real estate transaction by dictating what must happen so the contract becomes legally binding. If certain conditions aren’t met, the applicable contingency gives the buyer and the seller the right to back out of the contract per their agreed-upon terms. When selling your home, a buyer may make their offer with contingencies attached. Here are some common contingencies you might see in a buyer’s offer and what they mean for you.

Common Real Estate Contingencies

Home Inspection Contingency

A home inspection contingency allows the buyer to have the home professionally inspected within a certain window of time. If the buyer finds outstanding repairs that need to be made, they can negotiate them into their offer. If the seller chooses not to make the repairs outlined in the buyer’s home inspection report, the buyer can cancel the contract.

As a seller, it’s important to be transparent in listing any issues with the home. This is why many sellers find a pre-listing inspection to be beneficial: it provides transparency about the home’s condition ahead of time and can help to streamline the buying process, which can be especially helpful when selling in competitive markets.

Financing Contingency

Also known as a “mortgage contingency,” a financing contingency gives the buyer a specified period of time to secure adequate financing to purchase the home. Even if a buyer is pre-approved for their mortgage, they may not be able to obtain the right loan for the home. If they are unable to finance the purchase, the buyer can back out of the contract and recover their earnest money, and the seller can re-list the home.

The seller won’t be on the hook if the buyer fails to cancel the contract. Even if the buyer is not able to secure financing by the agreed-upon date, they are still responsible for purchasing the home if they do not terminate the contract.

Image Source: Getty Images – Image Credit: fizkes

Appraisal Contingency

An appraisal contingency states that the home must appraise for, at minimum, the sales price. It protects the buyer in that it allows them to walk away from the deal if the property’s appraised value is lower than the sales price, and typically guarantees that their earnest money will be returned. This can be an issue in certain markets where demand is driving prices up to numbers that appraisals don’t reflect. Depending on the agreement you make with the buyer, you may be able to lower the price of your home to the appraised amount and sell it at that price. When selling your home, remember that there is a difference between appraised value and market value. An appraiser’s value of a property is based on several factors using comparative market analyses, whereas market value is what buyers are willing to pay for a home.

Home Sale Contingency

If a contract includes a home sale contingency, it means that the buyer is tying their purchase of a home to the sale of their existing one. Though it is common for homeowners to buy and sell a house at the same time, attaching a home sale contingency to an offer does create some added variability in a real estate transaction that sellers should be aware of before accepting such an offer. This contingency allows buyers to sell their current home and use the proceeds to finance the purchase of their new one. Although you will have the right to cancel the contract if your buyer’s home is not sold within a specified time, you’re still waiting on them for the deal to go through, which means you could potentially miss out on other offers while you wait.

Title Contingency

Before the sale of a home goes final, a search will be performed to ensure that any liens or judgements made against the property have been resolved. A title contingency allows a buyer to raise any issues they may have with the title status of the property and stipulates that the seller must clear these issues up before the transfer of title can be complete. If an unpaid lien or unpaid taxes turn up in the home’s title search, this contingency also allows the buyer to back out of the deal and look for another home. A majority of sellers will pull a pre-title report to provide transparency for a smooth transaction.

These are just some of the contingencies you may encounter in a buyer’s offer. Work closely with your agent to understand the terms of these contingencies and how they impact the sale of your home as you go about finding the right buyer. For more information on the process of selling your home, read our blog post on common mistakes to avoid:

No Foolin’

This is not an April Fool’s joke.

Average prices in Metro Denver just exceeded $700,000 in Metro Denver. Larimer County isn’t far behind.

For the month of March, the average residential sales price in the 5-county Metro Area was $704,000. This does not include Boulder County.

Larimer County was $691,000 and we expect to see an average exceeding $700,000 in the very near future.

It’s also interesting to note the average price for properties currently listed for sale and not sold yet. In Larimer County it is $848,000 and in Metro Denver it is $1,100,000.

You might be asking, why have prices appreciated to this level? Quite simply, supply and demand.

The Front Range has a healthy, growing economy plus an incredibly high quality of life. Meanwhile, standing inventory is low which results in upward pressure on prices.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link