RSVP Time

There are four key questions that our clients have right now:1. What will values do this year and is there any chance of a housing bubble?2. When will mortgage rates drop below 6%?3. Will inflation subside this year?4. Is now a good time to buy or sell? All of these questions will be answered by our Chief Economist Matthew Gardner on February 1st at our annual Market Forecast. Fun Fact, Windermere is the only real estate brokerage in the United States with a Chief Economist. You can RSVP for Matthew’s lively and informative presentation at ColoradoForecast.com.The Windermere Forecast is at 5:30pm on Wednesday, February 1st at the Fort Collins Marriott.

Inflation and Housing

- Higher real estate consumer confidence as fears of inflation will likely subside and people will feel wealthier as their investment accounts rebound

- Lower mortgage rates because they track the yield on the 10-year treasury which has fallen over 8% since Friday

War and Interest Rates

Our clients are curious to know what the conflict in the Ukraine will mean for mortgage rates.

The short answer is down in the near term and up in the long term.

Generally speaking, economic and political uncertainty drive people to invest in bonds rather than stocks, which puts downward pressure on interest rates.

So, in the near term, the conflict in the Ukraine will push rates down slightly. We have already seen this happen as 30-year rates have dipped in the last few days.

The conflict is likely to push oil prices up which means higher gasoline prices. This will cause upward pressure on inflation, which ultimately causes upward pressure on interest rates.

So, the longer the war lasts in Europe, the more likely it is to push interest rates even higher.

2022 Forecast

Yesterday we held the annual Real Estate Market Forecast with our Chief Economist, Matthew Gardner.

To get the recording of the full presentation, please reach out to your Windermere real estate broker.

Here are some of the big takeaways from Matthew:

- The national economy is very strong and the rate of inflation is expected to slow during 2022

- There are many millions more open jobs available versus the number of unemployed people looking for work

- Mortgage interest rates are expected to reach 3.85% by the end of the year

- Home price appreciation along the Front Range will again be in the double-digits this year due to high demand, low supply and low interest rates

- Home price appreciation is not expected to sustain the current pace over the next few years, but no price declines are expected

In Perspective

Let’s put today’s home prices in perspective.

Appreciation has been significant over the last 18 months. Some people are wondering if it can last and if there might be a housing bubble.

There are two ways to look at prices. One way is in absolute terms. This is simply looking at the dollar amount a home would sell for at some point in the past versus the dollar amount it would sell for.

The other way is in real terms. ‘Real’ is an economics term which means that inflation is factored into the valuation.

For example, a gallon of milk costs more today in absolute terms than it did 15 years ago. However, in real terms, the cost is about the same as 15 years ago because inflation is factored in. The price of milk has essentially escalated at the same rate as inflation.

So, how about home prices? As we know, prices in absolute terms are higher than 15 years ago. To be exact, prices are 43% higher Nationally compared to 2006 according to Case-Shiller.

However, in real terms, prices are the same as 2006.

Over the last 15 years, homes have appreciated at essentially the same rate as inflation.

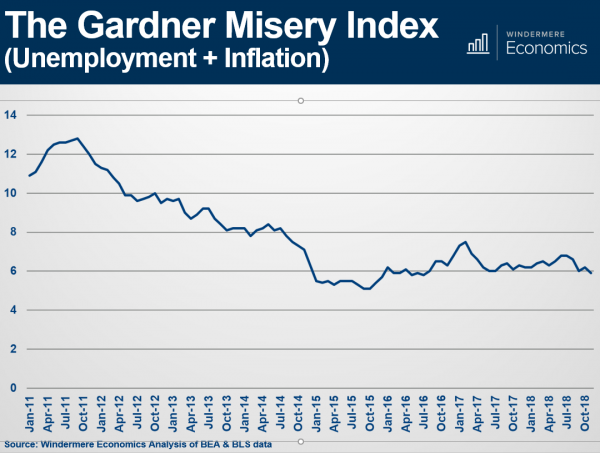

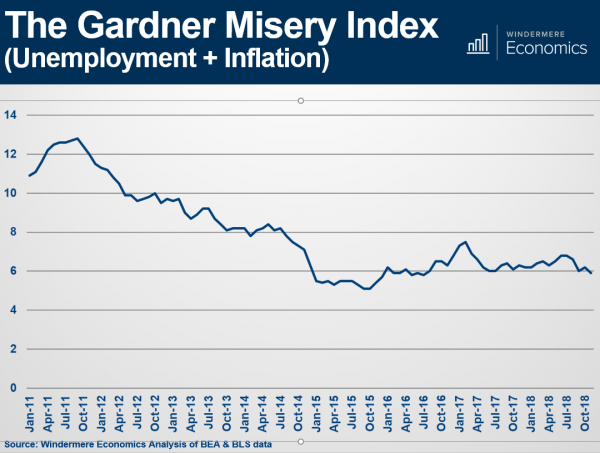

Misery Index

Last week at our Market Forecast events, Chief Economist Matthew Gardner shared, among many stats, his famous “Misery Index.”

A valuable statistic with a funny title.

The Misery Index simply measures inflation plus unemployment.

It’s an effective way to look at our Nation’s economy.

Today’s Index sits just below 6%. Back in October 2011, it was close to 13%.

The lowest it has been in the last 7 years is October 2015 when it was near 5%.

________________________________________

If you would like a copy of the entire Forecast presentation, go ahead and reach out to us.

We would be happy to put it in your hands.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link