No Middle Class

“The middle class is going away” is an often-used adage when talking about society. It is also a good way to describe today’s real estate market. When it comes to properties for sale, the middle class has gone away.There is a class of listings which are priced to the market, in great condition, with world-class marketing.Then, there are those that are overpriced, not in good condition, with sub-par marketing.Properties in the first class are selling quickly, sometimes with multiple offers and sometimes even over list price.Properties in the second class are sitting on the market.Sellers, who want a successful result, must be in the first class.Buyers, who want a bargain or who want to ‘wheel and deal,’ can typically only find those opportunities in the second class.Here’s the thing. Rising interest rates have caused buyers to be more picky. Yet, low inventory has caused competition for the best properties.Both sellers and buyers need to know there is no middle class when it comes to listings.

No Bear

Altos Research is one of the most trusted sources of real estate market information in the United States. Each week they track every single home for sale across the Country. They analyze the pricing, supply, demand, and status changes for all listings. This amount of data allows them to expertly predict changes in the market.

Their founder, Mike Simonsen, recently said this about the current state of the real estate market:

“The most important thing to take away is that the most bearish scenarios for home prices this year are not taking place. If a buyer is sitting on the sidelines waiting for a home price crash, in general across the country that’s not happening.

“We can measure demand and the direction of future sales prices by looking at the percent of homes on the market with price reductions. This number, frankly, is lower than I would have expected given how few buyers were out in the fall. This a sign that sellers are not panicking and that smart, properly priced listings are getting their offers.”

The annual Market Forecast featuring Chief Economist Matthew Gardner is February 1st at 5:30pm. To see the details and to RSVP, visit www.ColoradoForecast.com

RSVP Time

There are four key questions that our clients have right now:1. What will values do this year and is there any chance of a housing bubble?2. When will mortgage rates drop below 6%?3. Will inflation subside this year?4. Is now a good time to buy or sell? All of these questions will be answered by our Chief Economist Matthew Gardner on February 1st at our annual Market Forecast. Fun Fact, Windermere is the only real estate brokerage in the United States with a Chief Economist. You can RSVP for Matthew’s lively and informative presentation at ColoradoForecast.com.The Windermere Forecast is at 5:30pm on Wednesday, February 1st at the Fort Collins Marriott.

The Big News

The big news this week is obviously the rise in interest rates.

Average 30-year fixed mortgage rates are now at 6.7% which is the highest they have been since July 2007.

So, how is this affecting the market? Here is what we notice…

There are fewer buyers in the market. Sales activity, measured by closed and pending sales, is down 30% compared to last year.

Prices, however, continue to rise. Average prices are roughly 11% higher than last year. This is driven by the market being under-supplied.

Inventory levels, as measured by months of supply, tells us we still have a Seller’s market. There is 2 month’s of supply currently for sale.

Ultimately, we expect the rise in interest rates to slow the pace of price appreciation. We believe the market will return to its long-term average of 6% per year.

Price Peek

Here is a peek at average residential prices along the Front Range through the first half of September and how they have changed versus one year ago:

- Larimer County = $663,000 up 11.6%

- Weld County = $511,000 up 4.5%

- Boulder County = $1,165,000 up 17%

- Metro Denver = $668,000 up 9%

The “R” Word

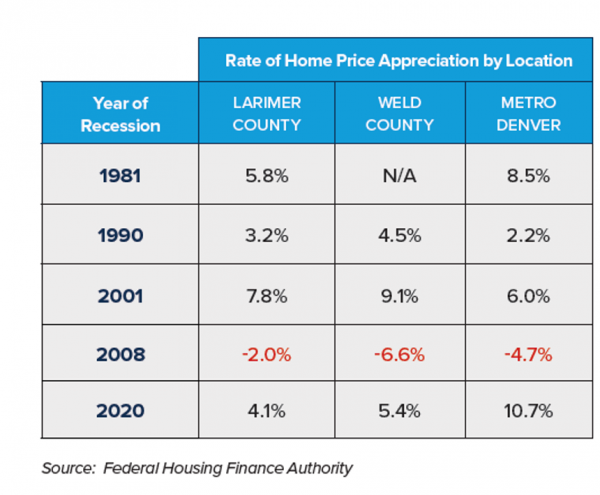

Our clients wonder what a recession would mean for the real estate market.

Many assume it would translate into a downturn in prices.

Some even worry that it would cause values to come crashing down.

We looked back in history, at past recessions, to gain an understanding of what recessions mean for the Front Range market.

We used the extensive data from the Federal Housing Finance Authority to look at home price appreciation during the five recessions dating back to 1981.

What we found was quite interesting.

During the five recessions of 1981, 1990, 2001, 2008 and 2020, home prices along the Front Range went up in all but the 2008 recession.

What was unique about 2008 was that housing led the recession. Whereas the other recessions were triggered by some combination of inflation, oil prices, and stock market issues (plus the pandemic in 2020).

So, if the past is an indicator of the future, a recession is not guaranteed to result in lower real estate prices.

The Front Range real estate market has always demonstrated long-term health and a great resiliency to outside economic events.

See the chart below for the detailed research…

Asking Price Drop

Data just released by Altos Research shows that 35% of all homes on the market have had to reduce their asking price.

This is the highest this number has been since December of 2019.

This is also an indicator of sellers adjusting to the reality of the new market where overly aggressive pricing is not effective.

Extensive research shows the importance of pricing a home correctly on the first day so that the home sells in an appropriate time frame.

What We Notice

Here is what we notice about the market right now:

- Listings are receiving fewer offers compared to 60 days ago – instead of 10 offers, a listing might have 2.

- There are now several instances of a listing only having one offer.

- Sellers who were overly-aggressive with their list price have to quickly reduce in order to generate activity.

- Inventory is up and in some areas significantly, giving buyers more options and flexibility.

- Home buyers who are under contract with a new home waiting for that new home to be built have been negatively impacted by rising rates.

- More buyers are considering 7 and 10-year mortgage products in order to have a lower interest rate.

- The pendulum is swinging away from the drastic seller’s market we have seen for the last 18 months.

Inventory Bottom

In Front Range markets, the number of homes for sale has just hit bottom or is about to hit bottom.

This is terrific news for home buyers who have been waiting for more homes to choose from.

The market is shifting, there is no doubt about that.

Prices are still increasing and we expect them to increase, just not at the pace they have been.

The inventory of homes for sale, which has been significantly down for two years, is finally starting to show signs of change.

We have been accustomed to inventory levels being down 30% to 50% compared to the prior year.

That is not the case anymore.

Inventory in Larimer and Weld County is now only down roughly 5% year over year.

Inventory in Metro Denver is now up 13.5% compared to this time in 2021.

We believe this is a legitimate shift in the market, not just a short-term anomaly.

No need to worry about prices crashing or a housing bubble. There is still too little supply and too much demand for that to happen.

However, the pace of price of appreciation will certainly get back to more normal levels of 5% to 6% per year instead of 20% to 25% per year.

Bottom line, this market shift has been a long time coming and is very good news for buyers.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link