Q3 2021 Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

The rise in COVID-19 infections due to the Delta variant caused Colorado’s job recovery to slow, but not as much as in many other states. The latest data (for August) shows that more than 293,000 of the 376,000+ jobs that were shed due to COVID-19 have returned. This is good news, with only 83,000 jobs needed to return to pre-pandemic employment levels. The metro areas contained in this report have recovered 243,700 of the 310,000 jobs lost, and I expect the state will recover the remaining jobs by next summer. With employment levels improving, the state unemployment rate currently stands at 5.9%—down from the pandemic peak of 12.1%. Regionally, unemployment levels range from a low of 4.4% in Boulder to a high of 6.1% in Grand Junction.

__________

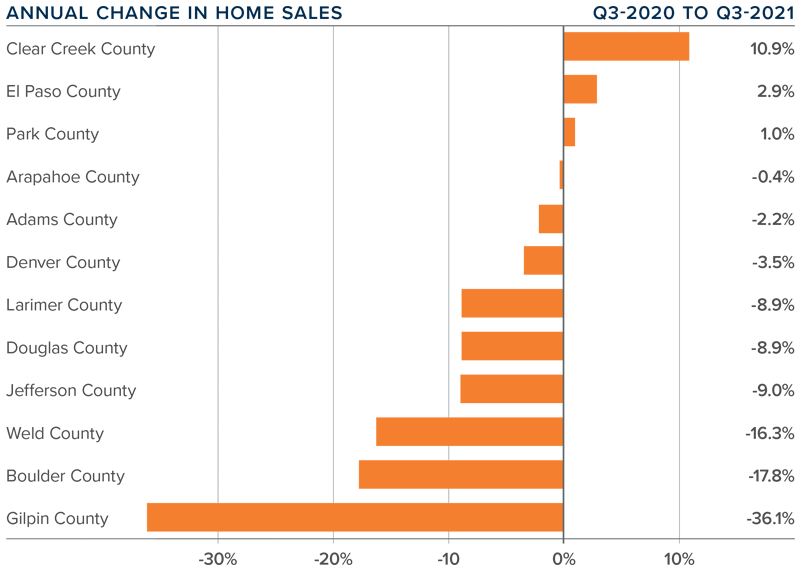

Colorado Home Sales

❱ Compared to a year ago, listing activity was down more than 30%. However, inventory levels were up 38.3% compared to the second quarter of this year, suggesting that buyers have more choice now than they have seen in some time.

❱ Although comparing current sales activity with that of a year ago is not that informative—given that the country was experiencing a massive rebound in housing demand following the outbreak of COVID-19—it was pleasing to see sales up in every county other than Denver and Douglas compared to the second quarter of this year.

❱ Pending sales (an indicator of future closings) were down 5.4% compared to the second quarter of the year, suggesting that closings in the final quarter may well be a little soft.

__________

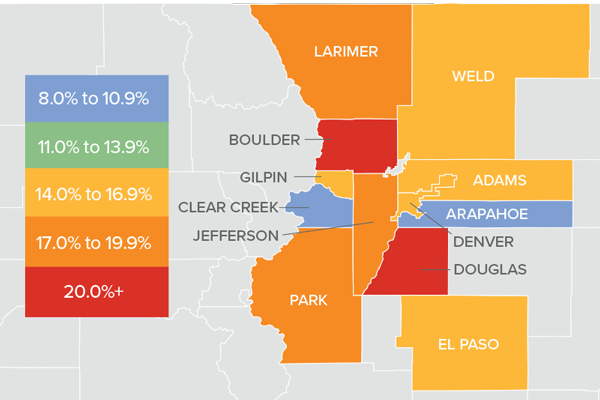

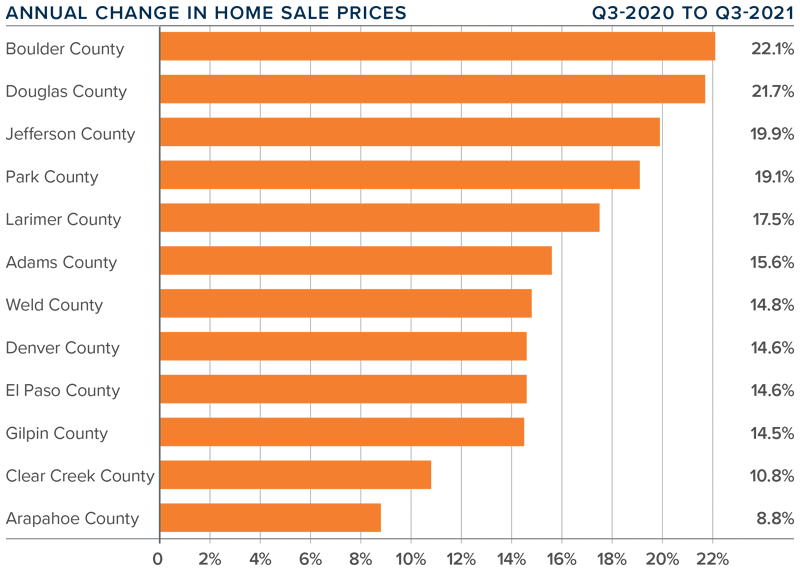

Colorado Home Prices

❱ Prices continue to appreciate at a very rapid pace, with the average sale price up 15.8% year over year to an average of $605,576. Sale prices were 1.6% lower than in the second quarter of 2021.

❱ Four counties—Arapahoe, Douglas, Weld, and Park—saw the average home sale price pull back between the second quarter and the third, but I am not overly concerned by this at the present time.

❱ Year-over-year, prices rose across all markets covered by this report. All counties except Arapahoe saw double-digit gains, but even that market saw an increase in sale prices.

❱ Several counties are experiencing a drop in average list prices, which is a leading indicator of future activity. As such, I expect to see the rise of sale prices start to slow, which will be a welcome sight for many buyers.

__________

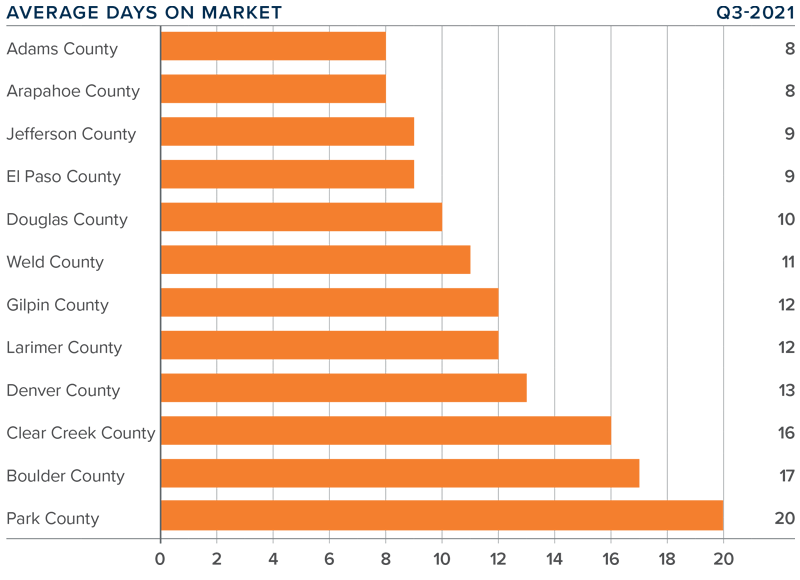

Days on Market

❱ The average number of days it took to sell a home in the markets contained in this report dropped 17 days compared to the third quarter of 2020.

❱ The length of time it took to sell a home dropped in every county contained in this report compared to both the same quarter a year ago and the second quarter of this year.

❱ It took an average of only 12 days to sell a home in the region, which is down 2 days compared to the second quarter of 2021.

❱ The Colorado housing market remains very tight as demonstrated by the fact that it took less than three weeks for homes to sell in all counties contained in this report.

Conclusions

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The job market continues to improve, which is always a stimulant when it comes to home buying. Inventory levels have improved, and lower pending sales suggest that buyers are taking a little longer to decide on a home. That said, the market is still bullish as indicated by the short length of time it took to sell a home in the quarter. Mortgage rates will start to creep higher as we move into the winter months, and this may stimulate additional buying activity. In the last edition of The Gardner Report, I suggested we would see more homes come to market and that has proven to be accurate. Given these factors, I am moving the needle a little toward buyers, but it remains a staunchly seller’s market.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

2 to 3

Along the Front Range we have gone from two weeks of inventory to three weeks.

For much of the Spring, there was only two weeks of inventory on the market in most areas. Meaning, it would only take 14 days to sell all of the homes currently for sale.

Now, because the pace of sales has slightly slowed down and there is a bit more inventory, there is roughly three weeks.

We can actually measure inventory in number of days based on the pace of sales in July so far:

- Metro Denver = 23 Days

- Larimer County = 22 Days

- Weld County = 22 Days

This is obviously good news for buyers as they have better selection and slightly less competition.

Millennial Buyers

Millennials often get a bad rap. One of the myths about Millennials is that they don’t own homes and will be renters forever.

Not true! Especially on the Front Range of Colorado.

Based on research by our very own Chief Economist, Matthew Gardner, Millennials make up a significant percentage of all home buyers in Metro Denver and Colorado.

In Metro Denver, 50% of all buyers last year were in the Millennial demographic.

In Northern Colorado, the number is 41%.

It turns out that Millennials, as they move into their mid to late 30’s, see the value of home ownership and are at the point in their lives where it makes sense to own instead of rent.

Home Warranties Provide Buyers and Sellers With A Peace Of Mind

If you are a homeowner, you probably know all-too-well how costly home repairs can be. And, thanks to Murphy’s Law, appliance break-downs seem to happen at the worst possible time—like when you are selling your home. For this reason, it is in the best interest of all home sellers to consider purchasing a home warranty.

If you are a homeowner, you probably know all-too-well how costly home repairs can be. And, thanks to Murphy’s Law, appliance break-downs seem to happen at the worst possible time—like when you are selling your home. For this reason, it is in the best interest of all home sellers to consider purchasing a home warranty.

A home warranty offers many advantages to the home seller, the least of which is a peace of mind that your major home appliances are covered in the event of a break down. Most home warranties cover both parts and labor of your home’s most vital systems and major appliances. This protects the home seller from potentially large, unexpected repair bills and also allows the buyer to purchase the home with more confidence. Additionally, a home warranty is usually for the term of at least one year, so any unforeseen repairs/replacements are also covered well after the home has been sold. A home warranty also provides a competitive edge over those homes without warranties because it communicates confidence to buyers. This can add up to a faster selling period, resulting in a more convenient process for all involved.

A home is probably the single largest investment you’ll ever make, so the last thing you want as a home seller or buyer, are unexpected home repairs/replacements. Major appliance replacement can cost you several thousand dollars, and during the process of a home sale/purchase, your budget doesn’t often allow for costly expenses. A home warranty is designed to protect you from these types of expenditures. Furthermore, it is convenient for home sellers because a home warranty offers after-sale liability. While an inspection may find many faults that are covered by a home warranty, it cannot account for latent problems that are beyond an inspection’s scope, or problems that occur down the road. In most cases, a home warranty will cover these expenses, alleviating potential financial burdens for the seller once they have sold the home.

When considering a home warranty, it’s important to ask the right questions. Warranties vary from one company to the next and there are also many different types of coverage available. Your Realtor should be able to help you with this process. First and foremost, you should identify which components of the home will be covered by the warranty. It’s also important to attain annual costs and the charge for service calls. You will want to ask what the total dollar limit is on the warranty and what the limits are for the individual items that are covered. Many home sellers purchase home warranties, which are then passed along to the homebuyer when they move into the home. As a homebuyer, you may want to look into whether or not the coverage can be renewed once the warranty has expired.

According to American Home Shield, one of the largest home warranty companies in the nation, the average home warranty customer uses their warranty plan 2.3 times. Furthermore, the number of home warranties is increasing with every year because homeowners are becoming more informed of their benefits. Eventually home warranties will become commonplace, as buyers and sellers realize the advantages they offer. Ultimately, what it comes down to is that a home warranty is a very simple, cost-effective way to purchase a peace of mind for both homebuyers and sellers alike.

Multigenerational Real Estate Trends

When making an important decision like buying a new home, personal circumstances are often a driving force. Whether you are a first-time homebuyer, need more space for your growing family, downsizing to fit an empty nest, or looking for a retirement property, finding the right information, the right real estate agent, and the right properties that fit your needs are all important parts of that process. Based on recent studies by the National Association of REALTORS® on generational trends, we can identify the best resources to help you in any phase of your life.

When making an important decision like buying a new home, personal circumstances are often a driving force. Whether you are a first-time homebuyer, need more space for your growing family, downsizing to fit an empty nest, or looking for a retirement property, finding the right information, the right real estate agent, and the right properties that fit your needs are all important parts of that process. Based on recent studies by the National Association of REALTORS® on generational trends, we can identify the best resources to help you in any phase of your life.

Among all generations, the first step most buyers take when searching for a home is online. Younger generations tend to find the home they eventually purchase online, while older generations generally find the home they purchase through their real estate agent.

Across generations, home ownership still represents a significant step in achieving the American Dream. According to a study by LearnVest, an online financial resource, 77 percent of those surveyed believed that buying a home of their own was, “first and foremost in achieving the American Dream”.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link