Friday Fun Facts – It’s All About the FED

You may have heard that the Federal Reserve Board (FED) is meeting next week – so what does that mean? Think of the Fed lowering interest rates like a store putting items on sale. When prices drop, people are more likely to buy things. Similarly, when the Fed reduces interest rates, borrowing money becomes less expensive. This encourages people to take out loans for homes, cars, or businesses, and helps boost the economy by making it easier and more appealing to spend and invest. It’s like making the cost of borrowing money more affordable, which gets things moving!

Want a house in Fort Collins? Grab $500,000, get in line and join the housing Hunger Games

“Buying a house in Fort Collins these days can feel like a combat sport. Maybe more like the

‘Hunger Games.’ Or Charlie Brown and the football — every time you get close to the ball,

Lucy whisks it away…”

Pat Ferrier at the Fort Collins Coloradoan breaks down the housing market in Northern Colorado with the help real estate professionals across the front range. Click the link below to read on!

Fort Collins real estate_ Average home price near $500K in market

Stat of the Month

We just completed a review of the September numbers in our market.

Here is the one number that is standing out to us – average price.

Prices are way up over last year. Here are the specific average price increases in each of our markets compared to September 2019:

- Metro Denver = 13.2%

- Larimer County = 16.9%

- Weld County = 7.4%

This change in prices has of course generated questions from our clients.

To help our clients answer questions about prices and other real estate topics, we have set up a private online event with our Chief Economist Matthew Gardner.

The event is set for Tuesday from 9:00 to 10:00.

Simply reach out to any Windermere broker to receive your registration link.

Matthew will be addressing these questions as well as many others:

- What effect will the election have on the economy and on real estate?

- How long can interest rates stay this low?

- Can prices keep appreciating at their current pace?

This online event is for the clients and friends of Windermere. If you would like to register, please connect with your Windermere broker.

Forbearance Falls

The number of loans in forbearance just fell to their lowest level since mid-April.

This is good news for the real estate market.

Less and less people are seeking payment relief on their mortgages.

The number of loans currently in forbearance stands at 7.16%.

This news coincides with the U.S. Unemployment Rate falling to it’s lowest level in 5 months as more people are getting their jobs back.

The economy has added back roughly half of the 22.2 million jobs that were lost in March and April of this year.

Spring in Summer

This year the Spring market is occurring in the Summer.

Typically the busiest months for real estate along the Front Range are April, May and June.

This year, because showing activity was restricted in the Spring months, we are seeing robust activity this Summer.

Here’s an indicator. Sales through July 2020 versus July 2019 are up:

- 12.6% in Metro Denver

- 17% in Northern Colorado

To see double-digit increases in sales despite was is occurring in the National economy, is nothing short of remarkable.

Job News

There is an abundance of great news when it comes to employment in Colorado.

The unemployment rate is incredibly low at 2.7% which is almost a full percentage point lower than the U.S. average.

According to the Bureau of Labor Statistics, Metro Denver added 28,300 jobs over the last year which ranks 15th out of all metropolitan areas nation-wide, many of which have much larger populations than Denver.

While this is positive news, what is even more remarkable is what is happening in the other, smaller cities along the Front Range.

Anytime job growth exceeds 2.0% per year, it is a sign of a very healthy economy.

Here is what the other Cities have seen in terms of job growth over the last 12 months.

• Fort Collins 2.6%

• Greeley 2.5

• Colorado Springs 1.9%

Misery Index

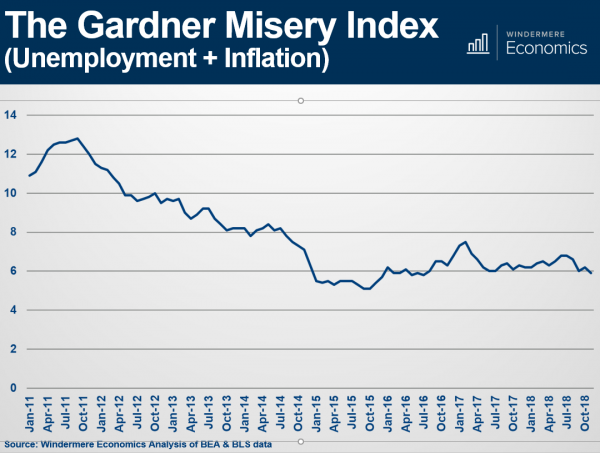

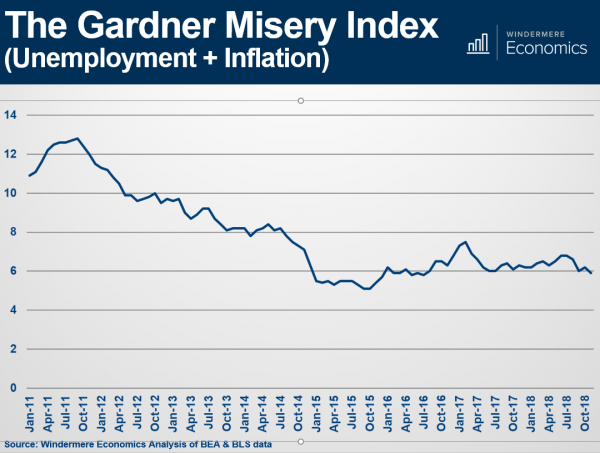

Last week at our Market Forecast events, Chief Economist Matthew Gardner shared, among many stats, his famous “Misery Index.”

A valuable statistic with a funny title.

The Misery Index simply measures inflation plus unemployment.

It’s an effective way to look at our Nation’s economy.

Today’s Index sits just below 6%. Back in October 2011, it was close to 13%.

The lowest it has been in the last 7 years is October 2015 when it was near 5%.

________________________________________

If you would like a copy of the entire Forecast presentation, go ahead and reach out to us.

We would be happy to put it in your hands.

FUNdamentals

In times of change (like now), it’s valuable to look at the fundamentals of our market.

Let’s have some fun with fundamentals…

1. Our economy is healthy – since 1990, the unemployment rate in Colorado has never been higher than the U.S. unemployment rate. Ever. Unemployment in Colorado sits at 2.7% today while the rate across the U.S. is 4.0%.

2. People keep moving here – since 2005 our population has grown by just over a million people which is roughly 77,000 per year (about the size of Mile High Stadium).

3. Our real estate outperforms other places – according the Federal Housing Finance Authority, Colorado is the #1 state for home price appreciation since 1990.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link