RSVP Time

There are four key questions that our clients have right now:1. What will values do this year and is there any chance of a housing bubble?2. When will mortgage rates drop below 6%?3. Will inflation subside this year?4. Is now a good time to buy or sell? All of these questions will be answered by our Chief Economist Matthew Gardner on February 1st at our annual Market Forecast. Fun Fact, Windermere is the only real estate brokerage in the United States with a Chief Economist. You can RSVP for Matthew’s lively and informative presentation at ColoradoForecast.com.The Windermere Forecast is at 5:30pm on Wednesday, February 1st at the Fort Collins Marriott.

2022 Forecast

Yesterday we held the annual Real Estate Market Forecast with our Chief Economist, Matthew Gardner.

To get the recording of the full presentation, please reach out to your Windermere real estate broker.

Here are some of the big takeaways from Matthew:

- The national economy is very strong and the rate of inflation is expected to slow during 2022

- There are many millions more open jobs available versus the number of unemployed people looking for work

- Mortgage interest rates are expected to reach 3.85% by the end of the year

- Home price appreciation along the Front Range will again be in the double-digits this year due to high demand, low supply and low interest rates

- Home price appreciation is not expected to sustain the current pace over the next few years, but no price declines are expected

Steady Stream

Despite the extraordinarily low amount of standing inventory, it is important to understand there is still a steady stream of new inventory hitting the market.

Inventory is low. That is a reality.

New inventory is coming on the market at essentially the same pace as compared to the last few years. That is also a reality.

Because demand is so high, the inventory doesn’t stay on the market very long. Residential listings go from ‘Active’ to ‘Pending’ very quickly (assuming they are priced correctly).

Over the course of 2021, there were 66,308 new residential listings that hit the market in Metro Denver. That is only 5% less than 2020.

Larimer County had 8,342 which is 7% less than 2020.

Weld County had 8,499 which is 5% less than 2020.

While standing inventory is near 50% lower than last year, the stream of new inventory is fairly consistent.

It is time to register for our annual Market Forecast with Chief Economist Matthew Gardner. This year the event will be hosted online on Thursday February 3rd from 11:00 to 12:00.

You can register at www.ColoradoForecast.com

Q1 2021 Colorado Real Estate Market Update

The following analysis of the Metro Denver & Northern Colorado real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

REGIONAL ECONOMIC OVERVIEW

Following the decline in employment last winter, Colorado has started to add jobs back into its economy. The latest data shows that the state has now recovered more than 219,000 of the 376,000+ jobs that were lost due to COVID-19. This is certainly positive, but there is a long way to go to get back to pre-pandemic employment levels. Denver and Fort Collins continue to have the greatest improvement in employment, but all markets show job levels well below pre-pandemic levels. With total employment levels rising, the unemployment rate stands at 6.6%, down from the pandemic peak of 12.1%. Regionally, unemployment levels range from a low of 5.6% in Fort Collins and Boulder to a high of 6.7% in Greeley. COVID-19 infection rates have started to increase again, and this has the potential to negatively impact the job market. I am hopeful that the state will not be forced to pull back reopening, but this is certainly not assured.

COLORADO HOME SALES

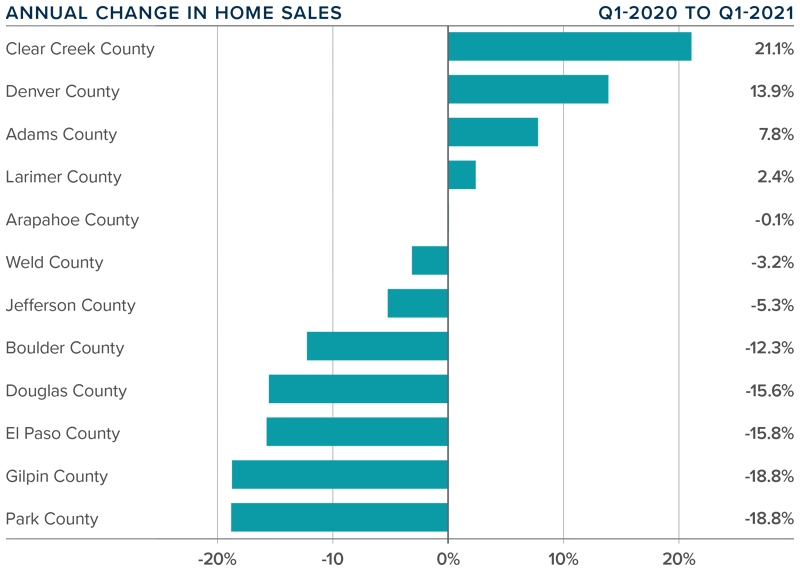

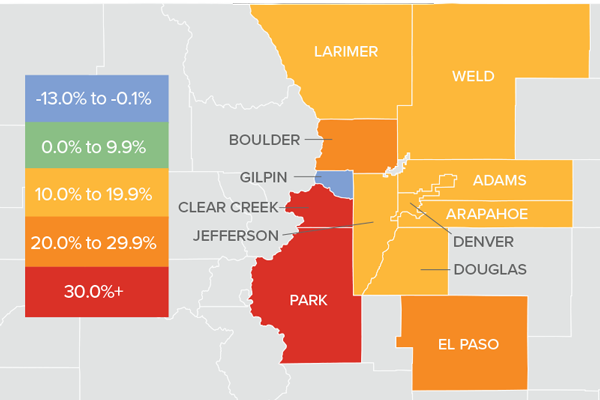

❱ 2021 started off on a bit of a sour note, with total sales down 1.2% compared to the same period in 2020. Sales were 29.2% lower than in the final quarter of 2020 as 8,645 homes sold.

❱ Sales were higher in four of the counties contained in this report, were essentially flat in one, and dropped in seven. It was pleasing to see significant sales growth in the large counties of Denver and Adams.

❱ Another positive was that pending sales, which are an indicator of future closings, were 4.8% higher than in the fourth quarter of 2020 and 5% higher than a year ago.

❱ The disappointing number of home sales overall can primarily be attributed to the woeful lack of inventory. Listings in the quarter were down more than 61% year over year and were 40.6% lower than in the fourth quarter of 2020.

COLORADO HOME PRICES

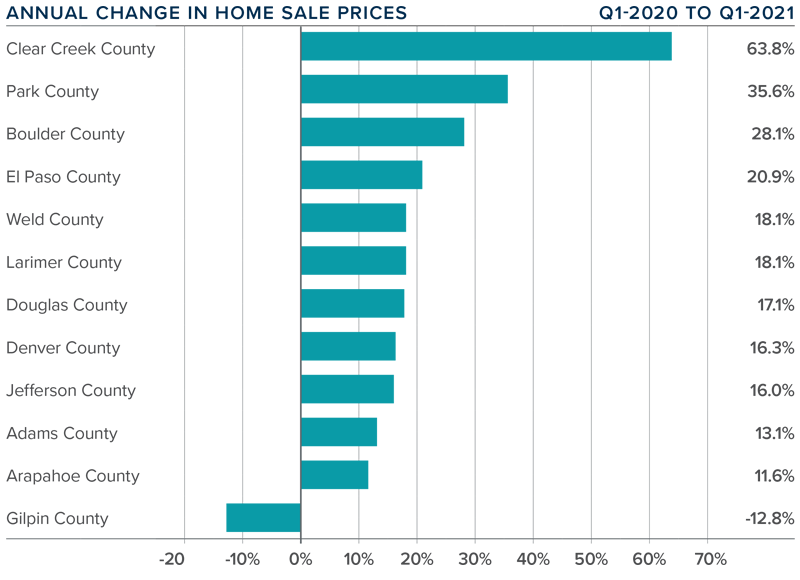

❱ Prices continue to appreciate at a very rapid pace, with the average sale price up 16.5% year over year, to an average of $556,100. Home prices were also 4.4% higher than in the fourth quarter of 2020.

❱ Buyers appear to be out in force, and this demand—in concert with very low levels of inventory—continues to heat the market.

❱ Prices rose over last year across all markets covered by this report, with the exception of the very small Gilpin County. All other counties saw sizeable gains and the trend of double-digit price growth continued unabated.

❱ Affordability levels are becoming a greater concern as prices rise at a far faster pace than wages. Even though mortgage rates have started to rise, they haven’t yet reached the level needed to take some of the heat out of the market.

DAYS ON MARKET

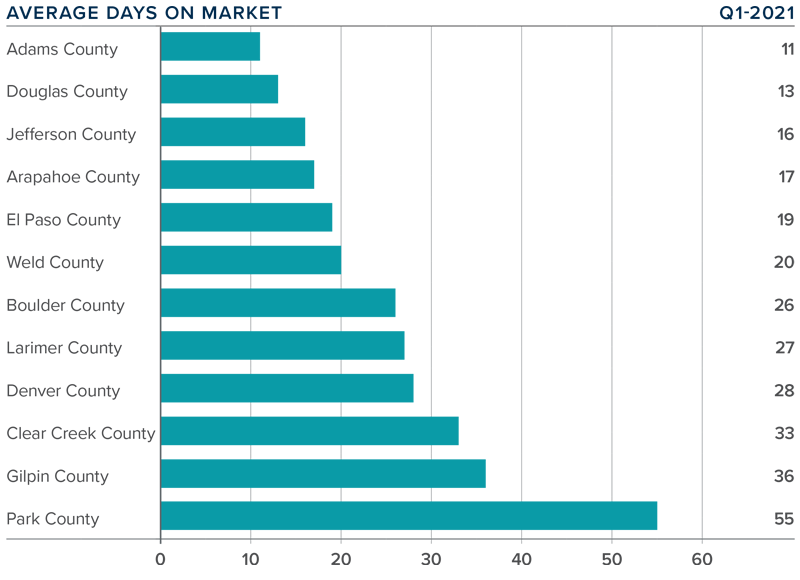

❱ The average time it took to sell a home in the markets contained in this report dropped 20 days compared to the first quarter of 2020.

❱ The amount of time it took to sell a home dropped in every county contained in this report compared to the fourth quarter of 2020.

❱ It took an average of 25 days to sell a home in the region, down one day from the fourth quarter of 2020.

❱ The Colorado housing market remains very tight, as demonstrated by the fact that it took less than a month for homes to sell in all but two counties.

CONCLUSIONS

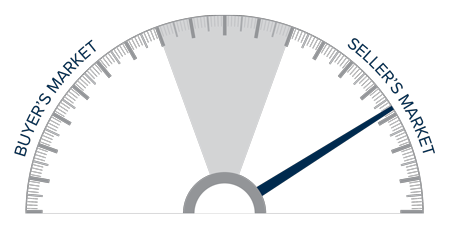

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The relatively low level of home sales is not a surprise given how few choices there are for buyers. Sellers are certainly benefitting from strong demand, as demonstrated by the significant price growth. I maintain my belief that there will be an increase in inventory as we move through the year, but it is highly unlikely that we will see a balanced market in 2021.

Given these factors, I am moving the needle a little more in favor of sellers, as demand is likely to continue to exceed supply.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

New Rate Prediction

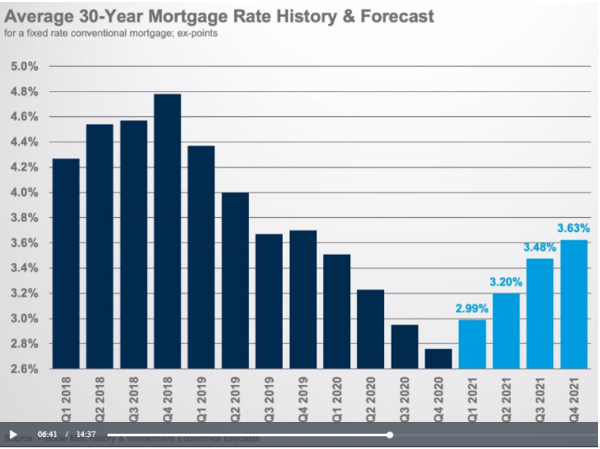

Windermere’s Chief Economist, Matthew Gardner has made his new mortgage interest rate prediction for 2021.

You can see his breakdown of interest rates and other economic factors by clicking on the image below and watching his newest video.

By the end of the year he predicts rates will rise to 3.63%. By the end of the 3rd quarter, he sees rates at 3.48%.

This would be a 0.5% increase by year-end compared to today.

What this would mean for home buyers is a 5% higher monthly payment compared to today.

Yes is the Answer

It turns out that ‘yes’ is the answer to the most common questions we hear right now about the market…

Do you think more properties will come on the market this Spring? Yes, the normal pattern in our market is for new listings to be 40% to 70% higher in April versus January. The peak month for new listings is typically June.

Do you think buyer demand will grow even more as time goes on? Yes, for two main reasons. Buyer activity, just like listing activity, increases significantly in the Spring and Summer. Plus, we expect the economy to open up even more as the COVID vaccine gets rolled out over the course of the year.

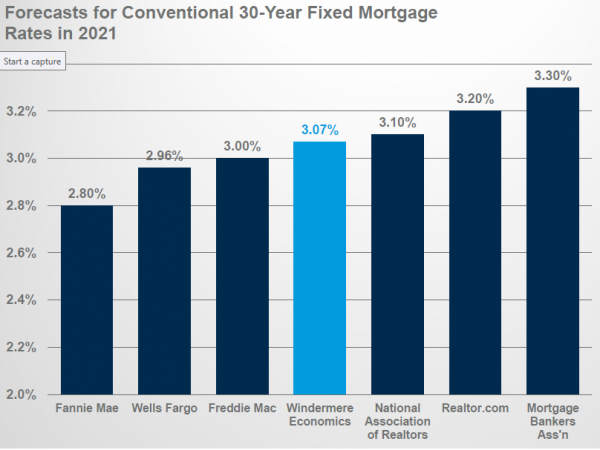

Do you think interest rates will go up? Yes, all of the trusted forecasters and economists expect rates to be slightly higher by the end of the year. Our own Chief Economist sees rates at 3.07% by year-end.

Do you think prices will keep rising? Yes, because of the simple economic forces of supply and demand. Supply is at historic lows. The number of properties for sale today is roughly 80% below the average. Demand is being fueled not only by the low-interest rates, but also a rebounding local job market that is poised to rebound even more. Plus, the new work-from-home dynamic positions the Front Range as a sought after place to live.

Rate Heading

Rate Heading

Where are interest rates headed?

This question was one of many which were addressed during our annual Market Forecast yesterday.

Our Chief Economist, Matthew Gardner, provided insight on rates, prices, inventory and many other fascinating topics.

Matthew’s prediction is for rates to creep up to 3.07% by the end of 2021. They are currently at 2.79%.

The image below shows how his prediction compares with predictions of his economist colleagues.

If you would like a recording of the presentation, simply reach out to your Windermere Broker or reply to this email.

Brand New Market Report

The latest quarterly report from our Chief Economist Matthew Gardner is now available. Here is a quote from the report with his take on the Front Range economy:

What a difference a quarter makes! Following the massive job losses Colorado experienced starting in February—the state shed over 342,000 positions between February and April—the turnaround has been palpable.

Through August, Colorado has recovered 178,000 of the jobs lost due to COVID-19, adding 107,500 jobs over the past three months, an increase of 4.2%.

All regions saw a significant number of jobs returning. The most prominent was in the Denver metropolitan service area (MSA), where 78,800 jobs returned in the quarter.

Although employment in all markets is recovering, there is still a way to go to get back to pre-pandemic employment levels.

The recovery in jobs has naturally led the unemployment rate to drop: the state is now at a respectable 6.7%, down from a peak of 12.2%.

Regionally, all areas continue to see their unemployment rates contract. I would note that the Fort Collins and Boulder MSA unemployment rates are now below 6%.

Cases of COVID-19 continue to rise, which is troubling, but rising rates have only slowed—not stopped—the economic recovery. Moreover, it has had no noticeable impact on the state’s housing market.

To receive a complimentary copy of the latest Gardner Report, simply reach out to us and we will send it to you right away.

Re Bubble

The activity in the Front Range market is causing us to hear the bubble question again.

People are curious to know, based on recent growth in price appreciation, if we are in a housing bubble.

This question seems to crop up when prices go up.

While we do not believe that the current double-digit price appreciation is sustainable, we firmly believe we will not see prices crash or see any kind of a bubble bursting.

Here’s why we think that…

This past Tuesday we hosted a private online event for our clients which featured our Chief Economist Matthew Gardner.

Matthew is well-known and well-respected in the industry. He is often quoted in leading real estate publications.

He sees four reasons why there is no real estate bubble that is about to pop in Colorado.

- Inventory is (incredibly) low. The number of homes for sale is down over 40% compared to last year. The market is drastically under-supplied. Based on simple economic principles of supply and demand, inventory would need to grow significantly for prices to drop.

- Buyers’ credit scores are very high. The average credit score for buyers last month, for example was 759. So, by definition, average buyers today have excellent credit which means there is low risk of them walking away from their mortgage and causing a foreclosure crisis.

- Buyers have high down payments. On average, buyers are putting 18% down on their purchases. This means that prices would need to fall by a considerable amount in order for the average buyer to be ‘upside down’ on their mortgage.

- Owners are equity rich. Well over a third of property owners along the Front Range have more than 50% equity in their homes. This means that a severe economic downturn causing a slew of distressed properties to hit the market is highly unlikely.

Bottom line, as Matthew Gardner reminded us, what we are experiencing in the economy today is a health crisis not a housing crisis.

If you would like a recording of the private webinar we would be happy to send it to you. Just reach out and let us know.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link